Teladoc and Livongo Merger Discussion

The addition of Livongo's remote monitoring capabilities completes Teladoc's vision to establish a true end-to-end virtual care platform

As many of my followers know, I have been a long-standing Livongo bull. I have written extensively on the company and owned a large position (now >1/3 of my portfolio) since last September. If you want to learn more about my bullish thesis, check out my Seeking Alpha post HERE. In this post, I will be discussing the merits of the Teladoc and Livongo merger and why I plan to hold my considerable position.

Initially, the merger seemed like a bad deal all-around. Teladoc paid a very high price tag for Livongo and Livongo was no longer a hyper-growth SaaS company. What compounded the confusion was that Livongo seemingly sold itself for a low-premium. But it is important to note that the delta between their stock prices widened significantly this past month. When they were discussing the terms of the merger it probably seemed like a significant premium on the LVGO side which quite reasonably might not have expected their stock to double after pre-announcing Q2 revenue guidance. I was disappointed too initially, as I believed Livongo would have produced greater returns for investors over the long-run alone. But after digesting the potential synergies between the two, I think this move could have strengthened the thesis and expanded the TAM and moat considerably.

Livongo’s Business Model

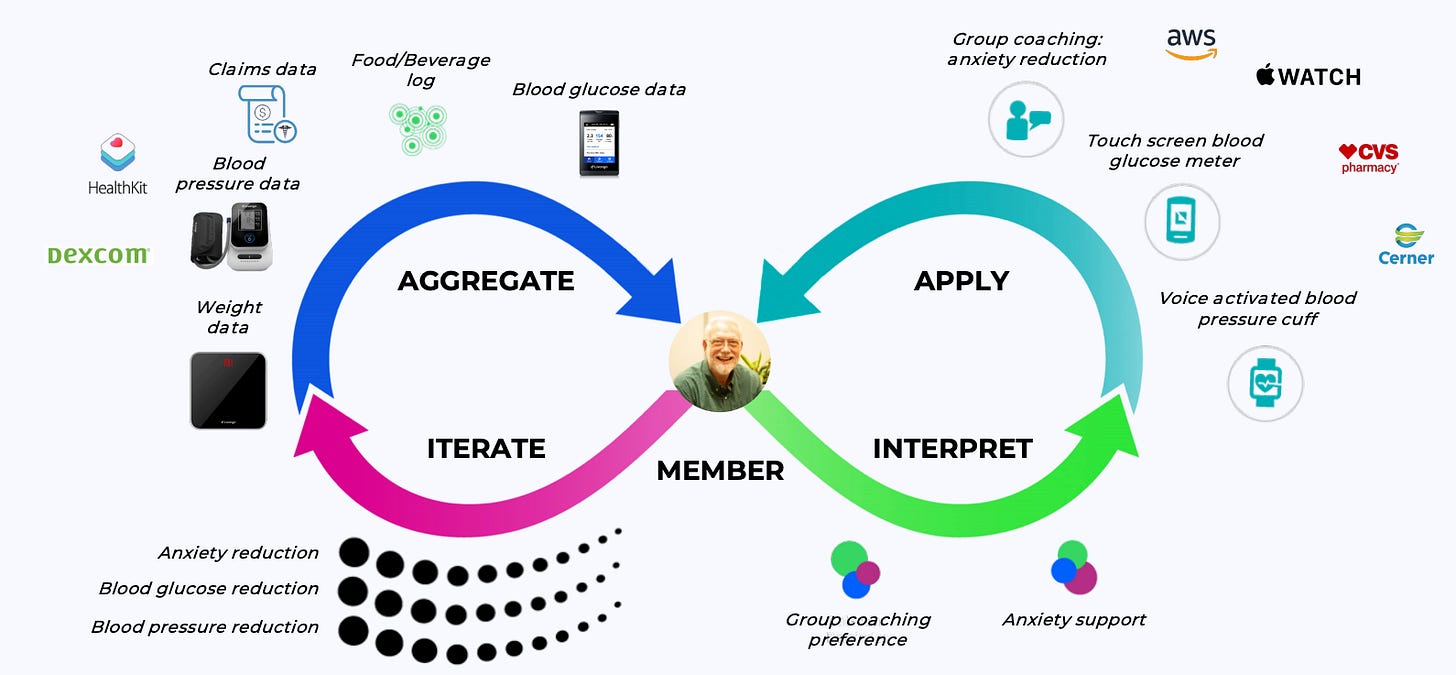

Livongo is focused on helping people manage chronic diseases through the combination of data science, connected devices, free and self-refilling testing strips, and 24x7x365 monitoring with access to personal coaches. It is currently primarily targeting self- and fully-insured employers who provide Livongo's services as a benefit to employees in an effort to curtail rampant healthcare costs. Livongo calls this unique category Applied Health Signals. Powered by their AI+AI engine, the platform aggregates data from first- and third-party health devices, medical and pharmacy claims, surveys, applications, and a multitude of other data sources. Even social determinants of health like commute time, where users do their grocery shopping, and how often they go to the gym can be synthesized by the platform. That data is then interpreted by Livongo's team of data scientists and clinicians to deliver timely health "nudges" at the right time. Each time a health signal is delivered, the engine collects valuable data to iterate and further personalize future interactions. Livongo's platform is validated by 34 peer-reviewed studies that show it lowered patients' blood glucose levels and achieved a 17% reduction in diabetes-related medical costs, an 11% drop in all medical claims, and 21% fewer ER visits.

AI+AI Engine; Source: Livongo Presentation

Livongo currently offers four products: Livongo for Diabetes (their primary product), Livongo for Hypertension, Livongo for Prediabetes and Weight Management, and Livongo for Behavioural Health. They also have a SAAS-style business model by billing clients on a month-to-month basis with multi-year contracts.

Teladoc’s Business Model

Like Livongo, Teladoc is a trailblazer. They are a first-mover in the telemedicine industry and is by far the largest with 51.5 million paid members as of Q2 2020 and a network of over 55,000 physicians in all 50 states, covering non-emergency care across 450 medical sub-specialties. These can be grouped into 5 categories including everyday care (flu, sinus infections, stomachaches, etc.), children and family, mental health, medical experts, and wellness & prevention (nutrition, back care, sexual health, etc.). Like Livongo, Teladoc sells subscriptions through channel partners and directly to employers. They also have a DTC channel that charges per visit, making up around 25% of their total revenue. They claim a win-win-win model for patients, payers, and providers like Livongo with that 92% of issues are resolved after the first visit, physicians earning up to 50% more per hour, and clients seeing significant ROI from cheaper fees ($75 for everyday care, $99 for mental health, and $95 for dermatology without insurance).

Source: Teladoc Health Presentation

An Industry Reborn

COVID-19 has made clear the limitations of a healthcare system focused on acute care. Not only were patients with chronic conditions at greater risk but they were unable to receive adequate care in an overwhelmed system. It’s a surprise to no one that both Livongo and Teladoc announced jaw-dropping results since the pandemic began, and both have been rewarded for it with rapidly appreciating valuations.

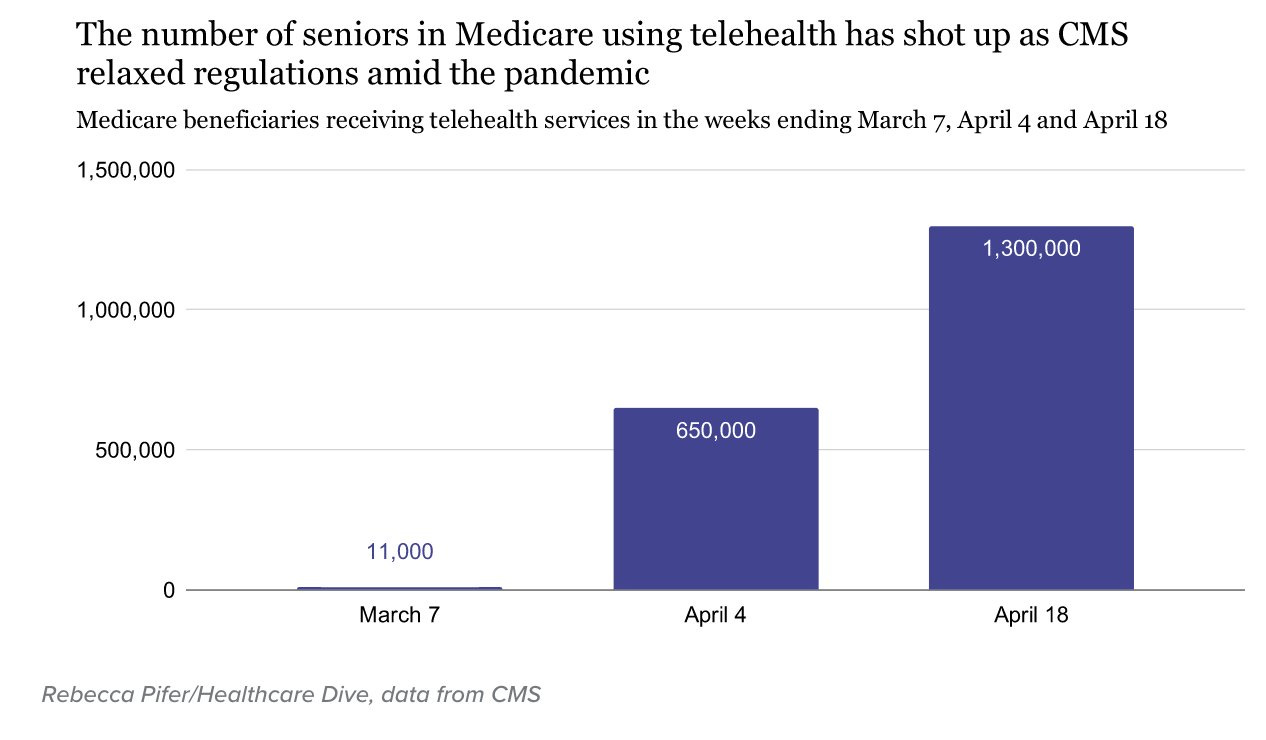

Healthcare has historically been very difficult to disrupt and that's not a surprise given the amount of bureaucracy and regulations that mired even simple advancements like electronic health records. Everyone likes to talk about being patient-centric but no one wanted to be the guinea pig. Because of COVID, hospitals became danger zones, and patients were exposed to telehealth en-masse. The traditional healthcare system was forced to adapt.

In 2019, 1 in 10 patients used telehealth services. A McKinsey study done in May showed that 76% are interested in continued access going forward. This interest is also reflected on the provider side which saw 50-175x the number of telehealth visits pre-COVID with 57% now viewing it more favorably. These are permanent societal shifts that have made telemedicine a household word.

Both the necessity and the demand for telehealth solutions have necessitated regulatory changes that would have previously taken years to occur in mere months. We are seeing permanent shifts in favour of extending telehealth reimbursement and removing geographic boundaries in delivering care. Instead of having to travel to an actual site of care to receive telehealth services, the patient can do it right in their homes. Previously, providers also needed to obtain some form of licensure in each state that they wish to practice in and that has been relaxed as well. New patients can now also access telehealth for a wider range of services without having to have a history with a specific provider. Remember these developments as I will explain in the next section how they help explain why this merger makes a lot of sense.

The Makings of a Healthcare Juggernaut

One of the keys to my Livongo thesis was that high healthcare costs and a frustrating, distant system based on maximizing volume rather than patient outcomes would influence consumers to seek alternatives. No one wants to get sick and go to the hospital, wait for 90 minutes for a 10-minute appointment where the doctor gives some generic advice and writes a prescription. Insurers also had a significant incentive to find solutions to manage costs with 50% of adults having at least one chronic disease and 40% having two or more. 90% of the $4 trillion spent annually on healthcare in the US is dedicated to people with chronic and mental health conditions and with a rapidly aging population, this is only expected to increase. This is also an issue for providers; a system focusing on one-time treatments instead of continuous care is unlikely to be able to keep up with these trends and this was made clear by COVID-19.

The system needs one digital platform to own the entire end-to-end patient journey, thus reducing costs by eliminating redundancies, enabling data to be shared more freely to deliver more contextual care, and creating a more intuitive, consumer-focused experience. Teladoc’s merger with Livongo allows them to do exactly that.

Source: Teladoc Health Presentation

Teladoc’s CEO Jason Gorevic realized this early and had plans to expand to chronic condition management eventually, saying that “our two companies were either on a path of convergence or collision”. Rather than compete and take away value from patients, they chose to merge and accentuate their strengths to deliver an unmatched value proposition.

Livongo’s primary moat was its distribution channels and partnerships. It wasn't the technology or product, which is not too complex and easily replicable by competitors like Omada. But Livongo was first-to-scale, which compounded their moat by allowing them to have demonstrated ROI and improved patient outcomes earlier and sign up blue-chip clients, thus giving them lots of data to iterate the AI+AI platform. That moat was vulnerable if someone like Teladoc with an existing large distribution network came in.

At the same, by focusing solely on telemedicine, Teladoc was vulnerable to Livongo because they didn't have relevant data nor the ability to deliver real-time, context-aware care. Telemedicine happens after there’s already a problem while remote monitoring can prevent that problem from happening in the first place. Meanwhile, 50% of Teladoc's users have a chronic condition, and there is only 25% overlap in clients. So there was a clear incentive for Teladoc to expand into Livongo’s space and the argument could be made that they could have done quite well against Livongo. Over 70 million people have access to Teladoc’s platform in the US alone while Livongo only has 410,000 members for its diabetes program. While many Livongo shareholders are justifiably disappointed that Livongo decided to sell out rather than attempt to compete, I think that in the long-run, the synergies between the two will result in a more successful company.

With the merger, Teladoc will serve as a massive funnel for Livongo’s programs. While Livongo was slowly expanding into the direct-to-consumer market, this accelerates it dramatically. Teladoc is also in more than 175 countries so they can help Livongo expand internationally much quicker than they would have alone. Although in completely separate industries, parallels can be drawn to Facebook’s acquisition of Instagram. Zuckerberg paid a seemingly outrageous price ($1 billion) for a company with no revenue and 13 employees in order to buy time to integrate Instagram's features at scale before Instagram could become a serious competitor themselves. Likewise, Teladoc is paying a premium price to integrate and deploy Livongo’s proven model at scale and improve both companies' value proposition at a time when they both are at their strongest.

End-to-End Patient Journey; Source: Teladoc Health Presentation

All these regulatory shifts will benefit the combined Teladoc Health company immensely in compounding their scale advantage. As mentioned previously, Teladoc has a network of over 55,000 physicians in all 50 states, including 450 medical subspecialties ranging from everyday care to mental health to wellness and prevention. With the help of Livongo's remote monitoring capabilities, we can learn more than ever before about each patient in real-time to see who needs treatment the most and what treatment is best for them so we can allocate Teladoc's national network of physicians to then provide personalized care anywhere, at any time. A patient with an obscure disease based in a rural area can get on a call with a national expert instead of getting on a plane. While Livongo previously announced a partnership with Higi to make it available at their Smart Stations as a baby step towards DTC, now patients can be directly referred to Livongo based on need by a Teladoc primary care physician. Physicians can then monitor their patients’ progress and prescribe medication if necessary, then remind the patient to take it in-app and adjust their treatment as necessary after reviewing their vitals. This a much more efficient allocation of provider time but also patient time and reduces the overall burden on the healthcare system and insurers.

Furthermore, as I mentioned previously, a big part of what built Livongo into an industry leader was its scale. They were able to get into adjacent conditions like behavioural health, prediabetes and weight management, and hypertension to become the one-stop-shop for chronic condition management. Their early success in diabetes allowed them to deliver more personalized recommendations using their AI+AI engine. The scale they will achieve with Teladoc’s distribution network could be incredible and widen the gap between themselves and competitors dramatically. As healthcare data is extremely valuable, whoever owns it has significant leverage. Facebook and Google were able to build mega-cap businesses and erect walled gardens in large part because of all the user data they collected. They built closed ecosystems and ensured zero data leakage and even forced advertisers and publishers to help them monitor user activity on external websites. Likewise, by owning the end-to-end patient journey, Teladoc will have a closed ecosystem that excludes the hospital system while leveraging patient data to deliver better care than hospitals for the majority of situations, which will force hospitals to work with them rather than try to shut them out. Rather than competing against unproven startups, Teladoc will have its eyes on the $4 trillion US healthcare system and eventually expand this revolution internationally.

Financial Considerations

In terms of financials, the combined Teladoc Health company will have $1.3 billion pro forma revenue in 2020, up 85% year-over-year. TTM gross margins come in at 67% with a positive adjusted EBITDA margin of 8% and projected annual expansion by 200-300 basis points. It expects $100M of revenue run-rate synergies by 2022 and $500M by 2025 and I think they can exceed these ambitious targets based on my previous analysis. As standalone companies, Teladoc was projecting to do 30-40% growth at minimum in 2021, while Livongo consensus estimates projected 55% growth. As a combined company, they are projecting 30-40% revenue CAGR pre-synergy through the next 3 years. While there are typical risks with any merger, Teladoc is no stranger to acquisitions. In fact, they’ve acquired 12 companies over the last 7 years including InTouch Health, TelaDietitian, BetterHelp, Consult A Doctor, MedecinDirect, Healthiest You, Advance Medical, Stat Doctors, AmeriDoc, CogCubed, Best Doctors, and Livongo. With the combined company currently trading at ~16x 2021 revenues, I believe there are few comparable growth stories on the market and that they should be able to continue to sustain high growth given their massive TAM and wide moat.

Source: Teladoc Health Presentation

A New Standard of Care

In Livongo Founder Glen Tullman’s book On Our Terms, he references Cuba’s healthcare model which employs 10 nurses and 25 care coordinators for every physician because they understand that well-trained care coordinators can provide most of the care needed. Combining education and simple intervention to make sure people can better manage their own health and leading to better outcomes for a lower cost. The best system must be one that is personalized because everyone’s body is different. A quarterly visit to the doctor is no more useful than recommending an oil change every 6 months based on the average rather than looking at what car a person has, how many miles they’ve traveled, driving conditions, etc.

Today’s health-care system is designed to treat acute problems, rather than empower people to live beyond the constraints of physicians and hospitals. The Affordable Care Act (ACA) helped shift the health-care system from fee-for-service to a value-based model and created the informed, connected health consumer who has financial responsibility and thus demands better service (tying reimbursement to improvements in clinical outcomes).

Teladoc Health gives consumers choice. With their end-to-end virtual health platform, they are able to deliver personalized care to those who need it, when and where they need it. COVID-19 showed the health consumer that there is a better alternative and the traditional healthcare system will be forced to change when consumers decide where they spend their money.

Feel free to reach out at richard.chu(at)sagapartners(dot)com

I think people need to scrutinize that $1.3b FY 2020 and then the $1.9b FY2021 number. $1.3b seems like the company is intentionally guiding low. The week before the merger, the TDOC announced their earnings, they guided to 980-995m for the year. LVGO had Q2 revenue of 92m and 1q reveue of 69m for 160m first half. Doing some basic math... 1.3B - 980m (TDOC low end guidance) means implied LVG revenue second half is 160m or no growth sequentially.

Meanwhile they are beginning to cross-sell this week, but even leading that out, LVGO has always grown squentially and they keep raising and beating. TDOC also has been beating and raising. To me, the most realistic situation is FY2020 revenue comes in closer to 1.4b, lets say 1.35B to 1.4B (do the math by looking at each company separately without cross-selling). That then means FY2021 is likely to also come in a bit higher since the base is higher, and that could be closer to $2.05B-$2.1B as opposed to 1.9B. It also means that the growth rates exiting those periods will be higher than expected.

If that turns out to be the case, these shares will be bid up to new highs IMO.

Thanks for the insightful article! Although I'm long on both LVGO and TDOC I have a couple of concerns, partially as an investor as the thesis around my investments has now radically changed and partially as my approach to apply the devil's advocate type thinking, especially when my own money is at play.

I was surprised to see the long list of acquisitions made by TDOC so far, I honestly was completely unaware and thought there had been only two (so mea culpa on background study). But the kneejerk question always is when seeing such a long list of acquisitions, how much they have been buying growth and revenue just to keep the numbers going, or have all of them really have been worth the cost in adding value to their solution? It could be either way, and it's relieving to a certain extent to know that TDOC has a strong experience with acquisitions needed in this merger, but it wouldn't be the first time a company is a bit too eager to but adjacent companies just for the numbers sake.

As a stock owner of LVGO/TDOC your optimism makes me feel good but, perhaps again playing the devil's advocate, I'm somewhat worried whether the new TDOC will become a healthcare titan that easily given the emerging and existing competition; while not all of these companies operate on the exactly same area it feels there's a bit of gold rush in this sector and any change in regulations or perhaps even macro economics could tilt the situation towards other players. Not in any particular order, but companies like Ontrak (OTRK), MTBC (MTBC), CVS Health (CVS), UnitedHealth Group (UNH) and more remote like Veeva Systems (VEEV), Guardant Health (GH).

Again, thanks for the excellent write up, I'll stick with both my positions at for the mid-term but I will definitely keep a close eye on developments in this sector.