Meet our sponsor: Revealera provides reliable job postings data for over 3,500 public + private companies, as well as technology market-share data for over 300 technologies (e.g Datadog, AWS, Asana) to inform better investment decisions. Learn more at http://revealera.com

Investment Thesis

The US real estate industry has traditionally focused on agents over consumers, leading to high inefficiency, exorbitant commissions, and an outdated consumer experience

Redfin enjoys cost leadership by hiring full-time, salaried agents and supporting them with leads from its popular website, technology, and support staff, resulting in industry-leading productivity

They pass savings down to consumers through lower commissions while retaining a high NPS

They enjoy a counter-positioning advantage against traditional brokerages and have consistently grown market share every year to reach 1.14% as of Q1’21

However, consistent profitability remains elusive without improvements in productivity or the success of new business models

Introduction

As with healthcare, real estate is one of the most broken industries in America and has been historically resistant to disruption. Today, owning a home is unaffordable for the average family in 59% of US counties and with home prices continuing to outpace wage growth, the issue is only becoming worse. In a recent Twitter thread, Redfin’s CEO Glenn Kelman commented that inventory is now down to record lows and home prices are at record highs. With the advent of remote work, rising housing prices have disproportionately affected those who are most vulnerable with 90% of people earning $100,000+ per year expecting to be able to work virtually, compared to just 10% of those earning $40,000 or less per year. All this leads to the unfortunate reality that homeownership, a quintessential part of the American Dream, remains out of reach for more people than ever.

Business

Real Estate Transactions

Redfin is a tech-enabled real estate brokerage on a mission to redefine the industry in the consumer’s favour. Its biggest departure from traditional brokerages lies not in its technology but in how it pays its agents. Instead of hiring agents as contractors, Redfin turns a variable cost into a fixed cost by compensating their agents largely through a salary with benefits. In combination with having the most-visited brokerage site, they are able to reduce homeowners’ listing fees from 2.5% to 3% to just 1.5% or 1% if they buy and sell with Redfin. This has helped save consumers nearly $1 billion since they were founded in 2006. However, they recommend that sellers still offer 2.5% to 3% commissions to the buyer’s agent in order to remain competitive, resulting in total fees of 3.5% to 4.5% versus the typical 5% to 6%. On the homebuyer side, they offer an average rebate of $1,750 per transaction. Redfin is able to do this because commission-based agents spend a significant amount of time prospecting for new clients whereas their salaried agents get passed leads from the website and can focus on more value-add activities.

Redfin’s website and mobile app were visited by an average of over 42 million people per month in 2020, more than 4x the traffic of the second-largest brokerage website. They’ve achieved this feat in large part due to the technology and data powering their website. Multiple listing services (MLS) are private databases established by brokers that aggregate information on listings, providing sellers more exposure while providing buyers with more options and offering commissions to both brokers. This effectively levels the playing field by providing all brokerages with access to the same listings. Zillow, the most popular real estate site, does not get the same access to these listings as Redfin because it is not a brokerage. Redfin’s unrestricted access allows them to show 80% of listings within five minutes of appearing in the MLS and notify consumers about new listings between three to 18 hours faster than leading real estate sites. This data also allows them to build the most accurate home-valuation tool with 64% of listings for which they’ve provided an estimate selling within 3% of that estimate, more than double their nearest competitor Zillow. This has led to industry-leading turnaround times with listings on the market for an average of 35 days in 2020 versus an industry average of 40. Redfin’s website design has been so successful in fact, that competitors have been accused of copying it! However, management called out in the last earnings call that its data advantage is being eroded and they are in a constant race to add more unique data to their website to stand out. Recently, they’ve published buyer’s agent commissions for over 700,000 listings for example and they were the first to do so. Previously, they were only allowed to do so for their own agents until regulatory changes. This will aid consumers in seeing exactly what they’re paying and what others are paying their agents and bring more price competition which is beneficial to a discount brokerage.

Year-over-year growth in monthly average website and mobile app visitors has steadily declined until the second half of last year, with less than half of that being due to market-driven trends. On the earnings calls, management has attributed it to higher search engine rankings and although that has declined in Q1’21 due to industry-wide trends, it remains strong.

Consumer habits are rapidly changing with 63% of homebuyers making offers on homes they hadn’t seen in person. Furthermore, 43% of home buyers started their search by looking online versus 18% of buyers contacting an agent, and 97% used the internet in their process. Creating an excellent online experience has never been more important. Redfin’s organic lead generation is a significant differentiator against traditional brokerages that primarily rely on agents’ networks. With less than 10% of leads coming from the Internet for traditional brokerages, it’s no wonder why they’ve been so focused on attracting and retaining the best talent.

Source: Redfin Survey

Consider EXP Realty’s model, which does away with physical locations in favour of a cloud campus and passing along the savings to agents through a very attractive 80/20 commission split with additional stock-based compensation for recruiting productive agents. This model naturally lends itself to viral expansion between a skyrocketing stock price and top agents recruiting their friends, however, agent turnover is high and it does nothing to ease the exorbitant fees and misaligned incentives that harm consumers.

Contrast this with Redfin, which removes its dependence on agents by sourcing its leads organically through its website. This allows Redfin agents to handle significantly more transactions with lead agents being nearly three times more productive than competing brokerages.

Agent incentives are also aligned with the consumer. With commission-based incentives, agents make more on larger transactions but often do not spend the time to get the absolute best offer, especially on lower-priced homes. Getting an extra $10,000 on the sales price may matter to the owner but translates to just $300 more commission for the agent so at that point, it makes sense to move on to the next transaction. This is made evident when considering agents sell their own homes for 3% more than a client’s. Buyer agents’ interests are even more misaligned as they make more if they get their client to accept a higher-priced home. On the other hand, Redfin agents get paid a bonus depending on the results of a customer satisfaction survey so they try to keep customers happy, even post-transaction. This model appears to be resonating with consumers, with Redfin’s NPS of +50 being 32% higher than competing brokerages and a repeat rate (buying and selling homes with the same brokerage) that was 54% higher. Buyers who have a positive experience with Redfin will also likely later choose to list their homes with Redfin, bringing some predictability to an otherwise cyclical industry. The percentage of brokerage customers who both buy and sell a home with Redfin was 13% in Q1’21, up from 11% the year prior.

However, at the end of the day, even though Redfin has vertically integrated agent supply, it still needs to hire, train, and retain agents to grow. To this end, they pay their lead agents twice as much at the median as competing brokerages and give them the comfort of a safety net by feeding them leads. Although top agents can earn more on an uncapped commission-based model, agents in aggregate appear to prefer Redfin as 77% retention is 9% better than competing brokerages.

Leads that Redfin agents don’t have the capacity to handle, are outside their service area, or are below their minimum commission (varies by market) are passed to their network of Partner Agents. These agents work for other brokerages like RE/MAX or Coldwell Banker but are still interviewed and have to maintain a 4+ star rating. Redfin does not offer any reduced commissions or refunds but receives a 30% referral fee. Revenue per transaction from partner agents is thus significantly lower than Redfin’s own agents and convert leads at a lower rate but runs at ~70% gross margins vs 24% for the brokerage business. Partner revenue grew 61% YoY and formed 4.9% of Redfin’s total revenue in 2020 because of the agent shortfall from furloughing 41% of their agents during March.

Redfin also offers a Concierge Service which builds a custom design plan recommending improvements to increase selling price and engage trusted vendors to do the work. This option would add a percent to overall commissions (2% to 2.5%).

Finally, Redfin Direct, launched in 2019, offers the option to buy a home without a buyer’s agent. This was Glenn’s second attempt at launching such a service as the first iteration in 2006 failed as buyers could make offers on homes where the listing agent worked for another brokerage. More than a decade later, Redfin has built up its listing inventory to the point where they can offer this service for Redfin-listed homes only and thus control who sees the house and when. The main advantage of this service is that by cutting out the buyer's agent fees, the seller pays a total of just 2% to 2.5% commission (1% to 1.5% listing fee and 1% Redfin Direct fee) instead of the 3.5% to 4.5% if they use a Redfin seller’s agent or 5% to 6% if they use a traditional agent. Thus, the buyer is thus able to quickly produce a significantly more competitive offer, and because they are vetted through a 55-question survey, educated, and given a standardized contract, the seller can be sure of legitimacy.

Redfin Direct runs at 90% gross margins so despite earning just lower fees, Redfin will make higher gross profits per transaction, incentivizing them to convert as many customers as possible. Traditional brokerages will not be able to introduce a similar service because again, Redfin holds a counter-positioning advantage by retaining full-time agents. Instead of losing 1% to 1.5% per transaction, they would lose 2% to 2.5% in order to match Redfin. They also wouldn’t have Redfin’s website and hence their listing inventory, making it impossible to implement it at the same scale and consumers will likely go with the website with the most selection. Zillow has the audience, but it is not a brokerage and would thus face the same challenges that Redfin did when they attempted it in 2006. Redfin’s focus on attracting sellers by discounting aggressively on the listing side is creating hard-to-replicate cross-side network effects. If Redfin is able to succeed in being the first to create a two-sided residential real estate marketplace that takes off, then profitability and growth could see an inflection.

Another addition to improving their listing inventory is the acquisition of RentPath, a network of rental websites ApartmentGuide.com, Rent.com, and Rentals.com. RentPath had $194M of revenue in 2020 and 16M average monthly visitors (+26% YoY). They were acquired for $608M in cash and the acquisition closed in April. The purpose of this acquisition was largely to reach more consumers and make Redfin.com a one-stop-shop for both buying and renting a home. They expect to integrate RentPath’s more than 20,000 listings by March 2022 and estimate that about a quarter of their current visitors are interested in rental properties.

Property

Redfin started its foray into iBuying in 2017, a new business model where companies use technology to estimate the value of a home and make a cash offer then turn around and relist it on the market. Consumers that are willing to take a slightly lower price in exchange for quick cash may choose to approach an iBuyer. Opendoor, Zillow, and Offerpad dominate the market with 50%, 26%, and 23% market share respectively as of 2020.

However, iBuying is very capital intensive and risky. This article discusses differences in more depth but they have different strategies. Opendoor's entire business model revolves around buying and selling as many homes as possible which leads to a cheaper cost of capital that it can pass along to the consumer as well as give it data to improve its estimates. Zillow, on the other hand, moderates its home purchases to achieve a scale where it maximizes seller leads. So Zillow can generate more gross profits with less risk by selling those leads to others and having the pick of the crop when it comes to its own iBuying program.

RedfinNow’s service fees range from 5-13% which are relatively more expensive than Zillow (1.5% to 7.9%) and Opendoor (3.5% to 5%). It is in 18 states currently and mainly offers another way to monetize its website traffic but is still running at slightly negative gross margins. I don’t see much of a competitive advantage against the other iBuyers otherwise, though management has acknowledged that iBuying is risky, but it sees it as more of a top-of-funnel customer acquisition offering for their other services.

Other Revenue

Redfin also offers mortgage origination and title settlement services which comprise other revenue, forming 3.2% of total revenues in 2020 and growing 60% YoY at 9.7% gross margins. Redfin Mortgage was launched in 2017 and is available in 21 states while Title Forward was launched in 2012 and is in 14 states. As of Q1’21, Redfin Mortgage was growing at 200% YoY with Glenn expecting 2021 to be a breakout year, while Title was flat with a return to growth not expected until 2022. The industry attach rate on title and mortgage is around 15% but Redfin is targeting a 50% attach rate on Title and over 25% for Mortgage. Bundling these services offers another point of differentiation against traditional brokerages but has been copied by competitors like Zillow. In addition, Redfin is competing against mortgage originators like Quicken Loans, United Wholesale Mortgage, LoanDepot, Fairway Independent Mortgage, etc. Quicken Loans also launched Rocket Homes in 2018 to compete with Zillow and Redfin, it’s a real estate search platform that matches customers with partner agents and is integrated with their mortgage platform. Title companies tend to be more commoditized and thus Redfin typically sees higher attach rates.

Opportunity

It should be no surprise that real estate is one of the largest but most fragmented industries. Redfin’s US TAM alone is $93B across 130,000 brokerages. Despite growing share consistently every year for the past five years, its market share still stands at just 1.14% as of Q1’21. The largest residential real estate holding company, Realogy Holdings, had 15.7% share.

Source: Redfin Investor Presentation

The largest bottleneck to market share gains has been customer acquisition with real estate agent productivity falling 31% on average since 1999. With inventory at all-time lows and the number of agents at all-time highs, finding leads has never been more difficult and there are now twice as many agents as listings. This makes Redfin’s highly-trafficked website a very valuable asset as they are able to pass their cheaper acquisition costs back to consumers. Rising home prices have also been a tailwind.

Redfin currently serves 95 markets across the US and Canada, up from 80 at the time of their IPO in 2017. Although they have not released cohort data since, in their S-1 filing, they’ve given perspective on how their earliest markets have evolved. All markets have scaled very nicely with margins and revenue continuing to grow at a fast pace within the oldest cohorts, suggesting that the overall business is not near saturation.

Source: Redfin S-1

Redfin has shown not just a strong track record of both penetrating deeper in its existing markets but expanding into new ones. The percent of real estate services revenue from their top 10 markets has steadily declined from 76% in 2015 to 62% as of Q1’21.

Competition

Despite being a fraction of the size, Redfin can successfully steal share from incumbents because it has a counter-positioning advantage. Traditional franchisors/brokerages like Realogy, Keller Williams, and RE/MAX would have to give up half of their listing revenues in order to compete and reinvent their business models to remain profitable. The same applies to tech-enabled brokerages like Compass that still hire agents as contractors. This is simply unfeasible even for a determined competitor. However, despite being cheaper, Redfin has some drawbacks versus traditional brokerages. Mainly, agents are a lot more hands-off as they deal with much more volume so, for a seller, this could mean selling for a lower price because the agents get paid regardless and for a buyer, this means having to search for a good home themselves instead of leveraging agents’ knowledge. This is particularly significant as buyers’ most important criteria was having an agent to help them find the right home. Nevertheless, another survey found that 56% of people who successfully sold a home asked their agent for a lower commission so clearly there is a large market for Redfin’s discount services.

Source: RE/MAX Investor Presentation (number of Redfin agents should be 1,757)

That being said, Redfin is far from the only discount brokerage. Some are even more aggressive with listing fees but none are close to Redfin’s size. They also operate under different models, Houwzer also hires full-time agents while Clever sources their own network of agents willing to accept reduced commissions.

However, it’s one thing to copy Redfin’s model but it’s another to be profitable while doing so. Without a consistent flow of new leads, retaining a base of full-time agents becomes structurally unprofitable. Despite having such a popular website, Redfin is yet to become profitable and to do so, they need to increase the transactions per agent. The latter has stagnated at ~34 per agent per year, while the former saw a nice bump in 2020 as Redfin handled fewer, but more profitable transactions at the expense of revenue growth.

As the earlier chart indicated, Redfin’s agents already handle more transactions than the vast majority of brokerages. When ZipRealty (acquired by Realogy in 2014) attempted the model, they had the most highly-trafficked real-estate website by 2010 and shared 20% of their commission with buyers, and reduced sellers' total commissions to 4.5% to 5%. However, they were unable to turn a profit and eventually had to switch to a commission-based model in 2010. The average agent was doing ~7 transactions a year and revenue per transaction and agent consistently declined. While Redfin has executed much better, this goes to show the difficulty of balancing agent count with the expected number of transactions.

Besides brokerages, Redfin also competes against real estate websites like Zillow, Realtor.com, and Trulia (owned by Zillow). In terms of user interfaces, the websites all have a similar look, you can schedule tours (with an advertising buyer’s agent in Zillow’s case), get details on the house, nearby schools, the neighbourhood, and see the price history.

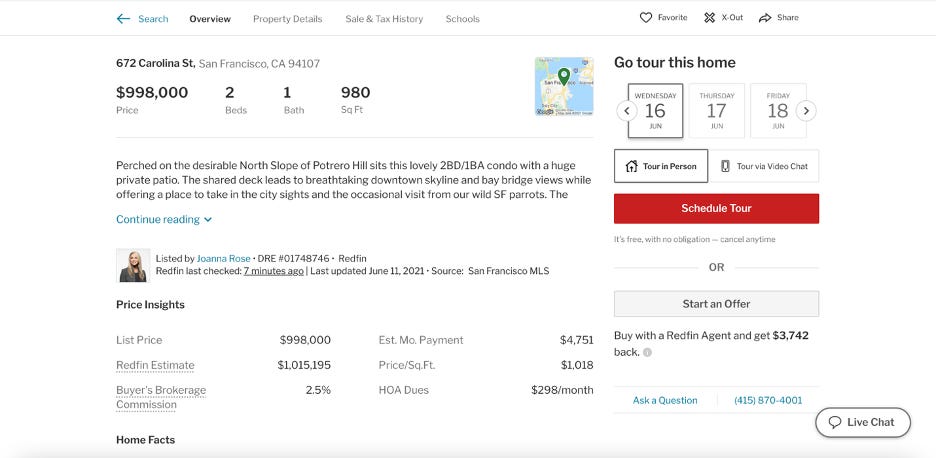

Redfin Website:

Zillow Website:

That being said, Redfin trails behind Zillow, Realtor.com, and Trulia in terms of monthly visitors, and rankings have not changed much going back 3 years but Redfin has been growing slightly faster.

Statistics from SimilarWeb via realestateagentpdx.com

In the past, Zillow has stated multiple times that it has no interest in becoming a brokerage, instead opting to monetize its leads through iBuying. However, they launched their own brokerage called Zillow Homes this year but it will be to support their iBuying operations. For sellers in Arizona, Tucson, and Atlanta, Zillow will require its own Zillow Offers employees to get licensed and streamline the process so that customers are dealing with a Zillow agent the whole way instead of passing it to local brokerage partners. Despite this, they’ve been very clear that their role is only limited to iBuying deals. Management has been very cautious about this as a significant source of revenue comes from selling leads to third-party agents and they would not want to be seen as a competitor. With gross margins in the 90s for its lead generation business, it would certainly not want to risk cannibalizing it to become a lower-margin brokerage. However, if Zillow were to decide to do so, it could cause significant disruption to Redfin’s plans as they have a much larger audience, something that is prerequisite to compete with Redfin Direct for example.

Management

Glenn Kelman joined Redfin as CEO in 2005 so although he’s not a founder, he’s been on board for pretty much the whole ride. One thing he certainly doesn’t lack is passion for redefining real estate in the consumer’s favour. In a 2007 interview, he boldly declared that “real estate is by far the most screwed up industry in America” and although his tone has softened a lot in recent years, he still retains all of his original drive.

In a 2018 interview, he says that his mission is to make real estate more affordable and leverage technology to improve the consumer experience. He comes across as very humble, honest, and passionate about what he’s doing. From sleeping on friends’ couches when he travels to save money and bringing that same frugality to capital allocation to talking about what they can improve on during earnings calls to exclaiming that he feels like he has to be the hardest worker at Redfin to earn his place as CEO. When asked about the stock during the same interview, he said he doesn’t really care or even check how it does in the short-term but cares deeply about creating long-term shareholder value: “I haven’t sold a single freaking share. I am so long on Redfin. We have grown a 10th, a 100th of what we’re capable of. We’ve invested so much in making the customer experience better, and we’re going to be reaping the returns for 20 or 30 years. It’s a great business. And what happens in between, I worry about all the time, but I can’t worry about it too much”.

Glassdoor reviews are good with a 4.1/5 rating. The main complaint is from lead agents that feel overworked and underpaid. Because Redfin agents handle 3x as many transactions as a traditional agent, this makes sense but so far, it looks like it is being managed as retention remains above average. In the last earnings call, Glenn said that they started paying a $1,500 retention bonus for new agents who could guide customers to the point of bidding on a home regardless of if those bids win. This was in response to attrition rates skyrocketing to 53% in Q1’21 vs 26% the prior year, but this was largely an industry-wide trend as the housing market got more competitive than ever.

Financials

Redfin has grown revenues at a steady 38% CAGR between 2014 and 2020 to $886.1M. Over the same period, monthly average website visitors have grown at a 30% CAGR and its market share has grown from 0.33% to 1%. There is some seasonality as Q2 and Q3 tend to be the strongest quarters of the year with a gradual decline over the last 3 or 4 months of the year and a gradual ramp-up in January. This can be a drag on the business as expenses do not decline proportionally during these down months with salaried agents. However, following this trend, Redfin has shown predictable growth with the only major hiccup in Q2’20 due to COVID and furloughing almost half their employees.

Gross margins have remained steady around 26%, with real estate services at 35.9%, properties at (2.2%) and other revenues at 9.7%.

The launch of RedfinNow has had a negative impact on overall gross margins but this was made up for by higher than usual real estate services margins last year at the expense of revenue growth as more leads were given to partner agents and revenue per transaction increased as a result of a shortage of agents. Redfin is seeing some economies of scale as operating expenses as a % of revenue has steadily decreased from 40% in 2016 to 26% in 2020, but not enough to swing it into profitability. However, if properties and other revenue is backed out, improvements seem to be very minor as evidenced by the chart below:

As the chart below shows, their iBuying business has seen tremendous growth over the last few years which is increasingly a risk given the volatile and capital-intensive nature of the business. This was most clear last year as Redfin suspended its iBuying operations (along with Zillow and Opendoor) in April before slowly restarting in June. Properties revenue was down 76% YoY in Q3’20 and because the average time from offer to sale is 5 months, RedfinNow didn’t return to growth until Q1’21 when gross margins turned slightly positive.

Source: Redfin

However, despite the rapid revenue growth, Redfin is still not sustainably profitable. The problem is that agent productivity has stayed stagnant at 34 transactions per agent per year which seems to be the upper limit. The bears think this is because of self-selection bias where top agents realize they can make much more under a commission model. However, there are still reasons why a top agent would want to stay with Redfin, both for the security of having a stable income and that they might not be able to replicate their success if they were required to source their own leads. In the Q2’18 conference call, Glenn mentioned that agents from outside the industry actually had higher customer success, productivity, and satisfaction rates, and lower attrition rates, supporting the idea that being successful as a Redfin agent requires a different skillset.

Keeping OpEx and COGS per agent constant, each agent needs to do at least ~39.3 transactions per year at $9,400 in revenue per transaction in order to break even. Management has attempted to improve productivity in the past through setting hard KPIs and bonuses but not every agent is going to be able to meet that standard and trying to force it might result in a worse customer experience. They can let go of the agents that aren’t able to perform but this would come at the expense of revenue growth.

At 34.4 transactions per agent, Redfin would remain unprofitable unless revenue per transaction were $10,728. Revenue per transaction is driven by Redfin’s pricing, the mix of homebuyers to sellers, home values, where the homes are sold, and the number of transactions that are referred to partner agents. As their fee structure indicates, Redfin makes more revenue representing buyers but the percentage of overall transactions from sellers has increased from 25% in 2015 to 44% in 2020. This has had a negative impact on revenue per transaction but to balance it out, Redfin lowers the commission refund to homebuyers as they tend to be less price-sensitive than sellers. From a strategic standpoint, it makes sense to focus on sellers as it helps build Redfin’s brand through marketing and controlling listing inventory unlocks additional optionality through segments like Redfin Direct.

Increasing home values have been a tailwind since 2013 with home values surging in wake of the pandemic as housing supply plunged due to relocation from remote work and low mortgage rates. This has helped lead to a higher revenue per transaction in 2020 and continued into the first quarter of 2021, reaching $10,927, before cooling off.

Source: Redfin

Lastly, revenue per transaction for partners is significantly lower than the brokerage, coming in at $2,858 in 2020 vs $10,040. However, it has also improved at a much faster pace, growing 26% YoY in 2020 alone vs 7.6% for the brokerage. Because of the significant discrepancy though, more partner revenue lowers aggregate revenue per transaction but has been decreasing since 2016 with the exception of 2020 due to an agent shortage. Overall, Redfin’s brokerage revenue per transaction should remain steady at their historical levels going forward.

Redfin could also try to sell improve attach rates for ancillary services like Mortgage or Title which should continue to improve in gross margins as they scale Redfin Direct at 90% gross margins.

It should be noted that although overall COGS per agent are steady, gross margins have continued to improve at a steady pace based on cohort data from their S-1. Again, management is likely trying to balance out the number of agents they hire.

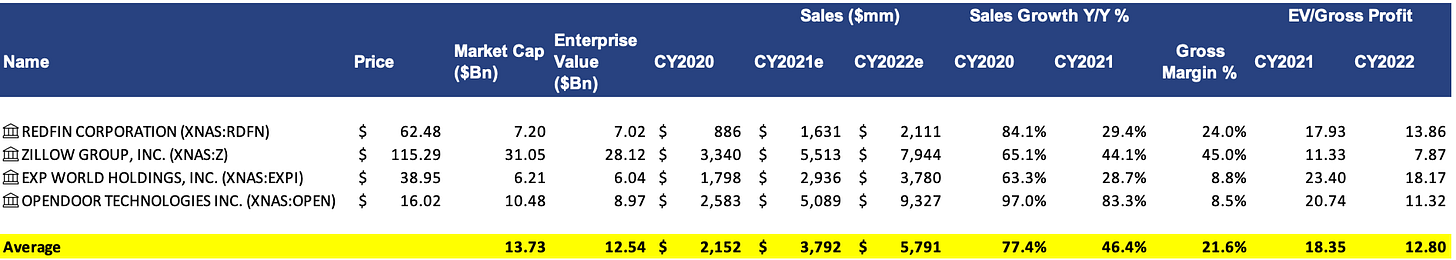

At 18x 2021 gross profit estimates, Redfin trades at a multiple relatively in-line with real estate tech peers. The market seems to be concerned about the risks highlighted though its multiple has expanded significantly, along with peers, in 2020. There should be room for continued multiple expansion once Redfin is able to prove they can maintain sustained profitability. Redfin has a stable balance sheet with $1.24B in cash and although they have raised debt, their current ratio stands at a very healthy 7x.

Risks

Economic Cycle – Buying is the biggest purchase that most people will make in their lives so it is very exposed to economic cycles and a downturn could significantly affect Redfin’s growth. Particularly, RedfinNow might not be able to resell the homes it buys at a profit and have to write down the inventory value of the homes. Also, because Redfin hires agents on a salary, it would be limited by the number of agents it can hire, train, and retain during good times and be stuck with a large fixed cost base during bad times. And although Redfin Mortgage does not service the loans themselves, they may not be able to sell its originated loans.

Competition – Redfin competes against thousands of other brokerages nationwide and its growth is largely limited by the number of agents it has and the leads it can generate through its website. Thus, this is unlikely to become a winner-take-most market. Although it is unlikely that traditional brokerages will be able to match Redfin’s commissions, they can still retain share through offering a full-service experience and the personal contacts of their agents. Also, Zillow is unlikely to become a brokerage but if it does, it will be a formidable competitor, especially to RedfinDirect, given their website traffic.

Operating Losses – Redfin has a history of operating losses and may not be able to sustain profitability unless it improves agent productivity or traction with ancillary services and Redfin Direct.

Conclusion

Redfin is making real estate more affordable by realigning industry economics around what’s best for the consumer, not agents. This has led to increasing consumer loyalty and steady market share gains with a model that traditional brokerages would be hard-pressed to replicate. While brokerages have access to the same listings via MLS, Redfin has excelled at creating a seamless consumer experience with its website. It is continuing to monetize this traffic beyond its core brokerage by adding ancillary services, an option for iBuying, and an option to buy without an agent. However, Redfin needs Redfin Direct to succeed and improve attach rates in order to become profitable without sacrificing its growth rate but Direct is still very early and requires a belief in Glenn Kelman’s ability to execute. Overall, Redfin is a solid business that is slowly disrupting traditional brokerages by undercutting them on price, but without improvements in productivity or a shift in business models, it will continue to be a tough slog to balance growth with profitability.

To learn more about Luca Capital and our investment philosophy, check out our investor letters and fact sheet HERE and mention how you discovered us!

Subscribe to my newsletter to get updates on new articles right in your inbox.

Disclosure: Richard Chu has no position in RDFN, Z, OPEN, or EXPI. Luca Capital and Saga Partners own shares of RDFN.