My Story

Who am I and how did I get started?

Unlike most investors you follow online, my investing journey started not too long ago in the summer of 2018 when I had just finished my third year studying Commerce at Queen’s University in Canada.

I know what you’re thinking and no, I’m not some child prodigy that was reading The Intelligent Investor for the umpteenth time while my peers were learning basic arithmetic. In fact, I had no interest in stocks at all before then. My parents had their boring mutual funds, my friends were all over cryptocurrencies at the time but didn’t know a thing about stocks, and my theory-based finance courses didn’t exactly spark my interest either. Plus, well I simply didn’t have much money TO invest.

One thing that I did love though was reading. I was interning at Playstation at the time and I was making a decent amount of money but I didn’t know what to do with it. So, I invested in a personal finance book you probably heard of called Rich Dad Poor Dad. Well, that taught me the importance of forming multiple income streams. Coming from a family of first-generation immigrants, I was always taught of the importance of securing that high-paying corporate job but what I wasn’t told was that if I wanted to be really successful I needed to make my money work for me.

What’s the one thing everyone has an equal amount of? Time.

Time is the great equalizer.

Everyone only has 24 hours in a day. Hence, there is only a finite amount of time that I can trade for money. And what if I lose my job? Well as Mark Zuckerberg put it, “the biggest risk is not taking any risk”. I’ve seen my parents and my friends work themselves to the core for that next promotion, to get a slightly bigger bonus, or in some cases just to keep their job. Yet much less frequently do I see people spending the time to learn how to compound that money.

The average annual return for the S&P 500 has historically been around 8-9%. I was 20 when I started investing. If I had invested $1000 then, assuming I compound that at 8% a year for 45 years until I retire, I would have $31,920. With the right mindset and time horizon, investing your money suddenly seems like a no-brainer! Like many young investors, I played around modeling what return I would need to get to become a millionaire in 10 years.

With a goal in mind, I knew that I had to invest as much as I could, as early as I could, and figure out how to compound my money as fast as I could.

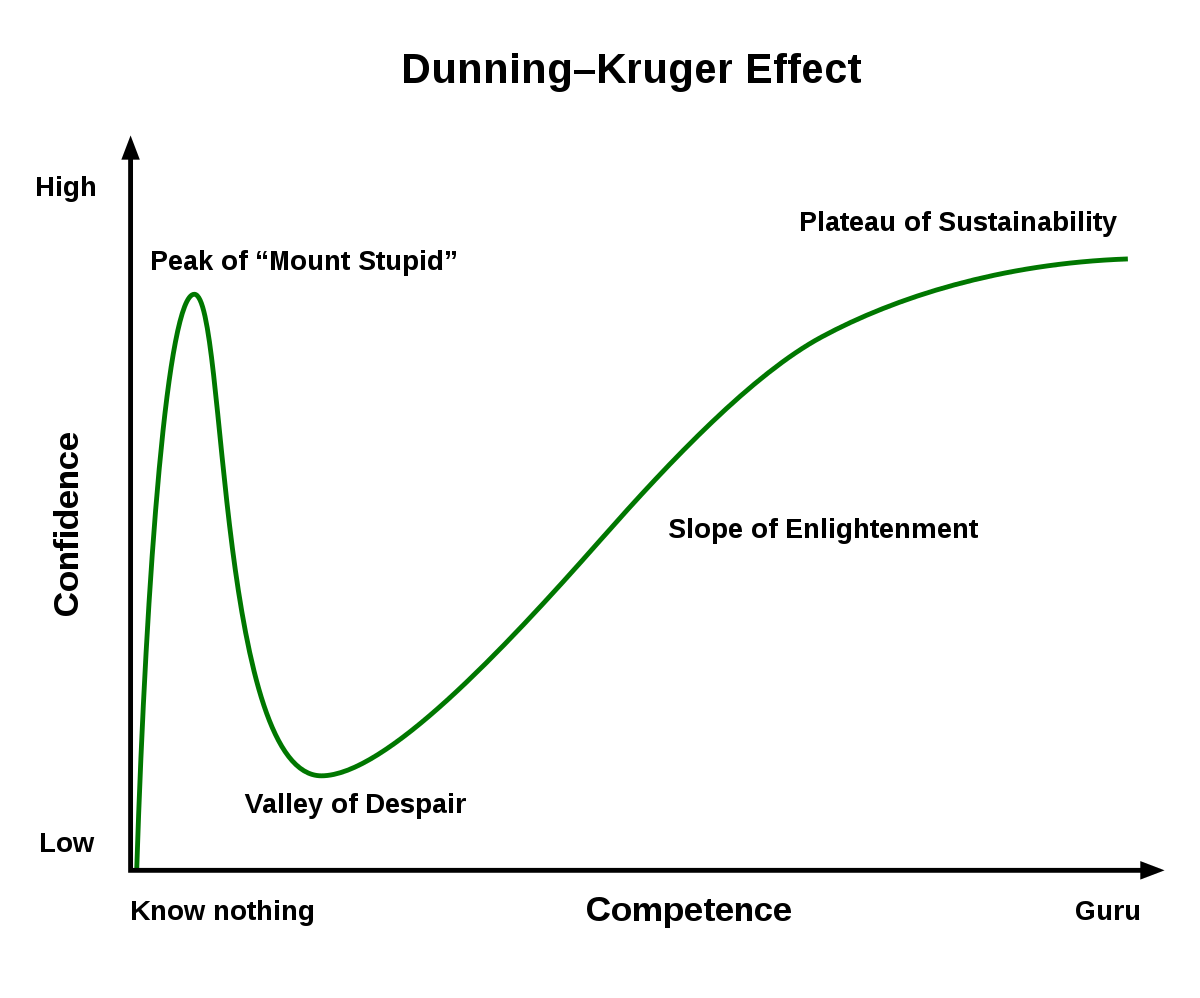

Well, it turns out that the combination of Reddit and Stocktwits, a new-found confidence in my investing abilities, and a non-existent risk tolerance results in me losing my money at a speed I didn’t even know was possible!

My First Investment

July 2018 was not a good time for $FB investors. Facebook had just announced disappointing Q2 earnings mired in concerns surrounding its slowest-ever user growth, the public backlash around its handling of fake news and concerns around privacy, and dismal guidance.

Well, I took Peter Lynch’s advice to heart and as a Gen Z, I can definitely count social media as within my circle of competence. I knew that Facebook’s moat wasn’t going anywhere and with a long term mindset, I bought my first stock the very next day.

At first, it felt good. I asked my coworkers if they had heard the news of Facebook stock losing $130 billion of value in one day, the largest ever in the US stock market. Then I proudly announced that I had bought Facebook stock. I was now a part-owner of the company whose products were inseparable in the lives of myself and my peers.

Well, little did I know that $FB’s descent wasn’t over, in fact, it had just begun. Over the next 5 months, FB dropped another 29% before bottoming with the December 2018 crash.

“I have not failed, I’ve just found 10,000 ways that won’t work”

-Thomas Edison

Well, while I haven’t done anything nearly as ambitious as inventing the incandescent light bulb, I certainly felt like Edison as I managed to find 10,000 ways to lose my money over the next couple of months.

Let’s see…penny stocks, value traps, options, hype stocks…the list goes on and on. Each lesson was painful but that was the only way I was going to develop the discipline I needed. Learning to stay away from options no matter how confident I was in a trade was a difficult lesson in particular and as a student, I lost what was not an insignificant amount of money.

My most popular tweet was on what makes a great investor:

In the end, it really comes down to your mindset. Willingness to learn from past mistakes is critical to success because no matter what it may seem like, everyone makes mistakes. What sets some investors apart is their intense desire to recognize, analyze, and learn from their own mistakes rather than simply repressing them. And boy oh boy was I desperate to learn.

Resurgence

Let’s fast forward to summer 2019. Up until this point, I was getting my information from wherever and whoever I could. I had a subscription to multiple Motley Fool services, I had a voracious appetite for books, and I was scouring Stocktwits, Reddit, YouTube, trying to find a good community to learn from.

It wasn’t too long before I discovered there was a community of experienced investors on Motley Fool that had incredible performance and discussed hyper-growth companies in extreme detail. I was immediately drawn to the quality of the discussions and their very particular investment philosophies. SaaS companies were mostly foreign to me, I had invested in Okta as it was a Fool Recommendation and I had loved using it during my internship at PlayStation but besides that, I obviously didn’t have much exposure or understanding of what these companies did.

I dove deeper. I hopped on Seeking Alpha and consumed Bert Hochfield’s wonderful articles on SaaS and around the same time, I had discovered FinTwit and subscribed to Ophir’s CML Pro service as well as Beth Kindig’s premium blog. I also loved Alex Clayton’s S1 breakdowns on Medium. I was enlightened. The strategy made sense, the companies were killing it, and their performance spoke for itself.

I sold off many of my existing positions and bought a basket of high-growth SaaS companies after doing hours upon hours of research.

A Test of Conviction

Well, remember what happened to high-growth SaaS multiples in Q3/Q4 2019?

Chart from Public Comps

I sure picked a good time to invest right?

I’m not going to downplay it, watching my portfolio collapse while the stocks I had sold like Tesla continue to rise, especially when I didn’t have a cushion was painful. Being a part of a community definitely helped me handle the volatility better. When my stocks dropped for seemingly no reason after reporting great earnings, I initially bought the dip. Then they continued to drop…and drop…and drop.

I first bought Livongo in early September at $30 and thought I was getting a good deal! Of course, that was before it dropped another 50% in a MONTH on no news before bottoming just above $15 in early October. I kept buying on the way down and I had also just started working full-time as a technology consultant for EY at the time so I had a steady income stream.

This was really a formative period for me as an investor. In order to survive the volatility, I needed a ton of conviction. I spent almost every spare moment I had on learning as much as I could about these companies.

Of course, the correction eventually ended and I was more excited than ever for 2020. Having spent the better part of the last two years consuming knowledge from the smartest investing minds I could find, investing was no longer a hobby, it was not simply another income stream, it was an unbridled obsession.

A New Beginning

Naturally, I started exploring how I could turn this into a career. I’ve always known that I wanted to work with technology but my work as a technology consultant wasn’t right for me. It was too granular. Even something like product management, I don’t think I would have enjoyed being tied down to one focus area. The great thing about investing is that you’re always learning something new, you’re always on the look-out for the next great investment. I was hungry and determined to find the next winning investment before everyone else.

Starting on Twitter and Seeking Alpha

Although finance was one of my focus areas at Queen’s, I did not have much in the way of actual finance experience. If I was going to achieve my goal of breaking into the buy-side, I needed to showcase my passion and knowledge in some other way. So, I decided to start posting my monthly portfolio on Twitter. Partly as a journal to reflect back on, partly to share insights with other like-minded investors, and partly as a virtual resume of sorts for when I do apply to jobs.

At the start, I didn’t even think that anyone would follow me. I remember being shocked when people I didn’t know in real-life started liking my portfolio and following me. But sharing my holdings wasn’t enough. I had to explain my convictions and after two years of dedication, I finally felt comfortable enough to share my ideas and thought processes.

Livongo ($LVGO) was one of my largest positions at the time and I had so much conviction in the company but I barely saw anyone talk about it on FinTwit. So I came out with a thread explaining why it was my top 2020 pick.

That’s when my profile started to really take off. And I followed it up with a comprehensive breakdown on Seeking Alpha.

I didn’t have much of an audience at the time and Seeking Alpha seemed like the best place to connect with experienced investors and maybe some buy-side professionals will even read it. I probably spent around 30 hours reading every piece of public information I could find on LVGO and writing that article and got paid around $65. Obviously, the intent was not to make money, it was to build my brand and that I did. It started when the investors that I had admired on FinTwit and the Motley Fool Forums, people who I considered my mentors, shared my article within their circles. Not long after, I was contacted by Saga Partners, a small long-only fund based out of Ohio and the PM told me that it was one of the best articles he’s ever read on Seeking Alpha and invited me down to meet them. It was my big break.

Over the next few months, I continued to build my presence on Twitter, learning and sharing whatever I could. I was working 50-60 hours a week in my day job and spending the rest of my time thinking of my next thread or article. It didn’t take long for that work to start to pay off. One thing that I love about Twitter is that you largely get what you deserve and put in.

Not bad for someone who just started 8 months ago and didn’t know a thing about building an audience! When people ask me how I did it, my answer is simple: I tried to provide as much value as I could without asking for anything in return.

It wasn’t long after that I followed up on my LVGO article with another deep-dive on Elastic ($ESTC):

Remember that I don’t know how to code, I don’t come from a technical background, and I was just introduced to SaaS investing a year ago. Elastic is a very complicated company to understand but it was such an interesting one and, like with LVGO, there wasn’t much coverage on it so I took on the challenge. Again, I was delighted to receive very positive feedback from all of the investing forums that I was a part of, and now an active participant in. More buy-side investors took notice too, I even had an analyst working for a hedge fund I closely follow every 13F season tell me that it was the best article he has ever read on Elastic!

It certainly didn’t hurt that my portfolio was doing better than I could have ever imagined as well to the point where I earned more YTD with my investments than I would have in a full year with my job! It all felt surreal to me.

So What Now?

Well, that brings us to today. I decided to start my own Substack to continue to share my learnings in a format much more conducive to my writing and plan to share my future deep-dives here, where the most people can freely access them.

Feel free to continue to DM me on Twitter or email me at richard.chu(at)queensu(dot)ca if you have any questions or insights you would like to share. As always, I would really appreciate it if you could help me by sharing my Substack with your own network.

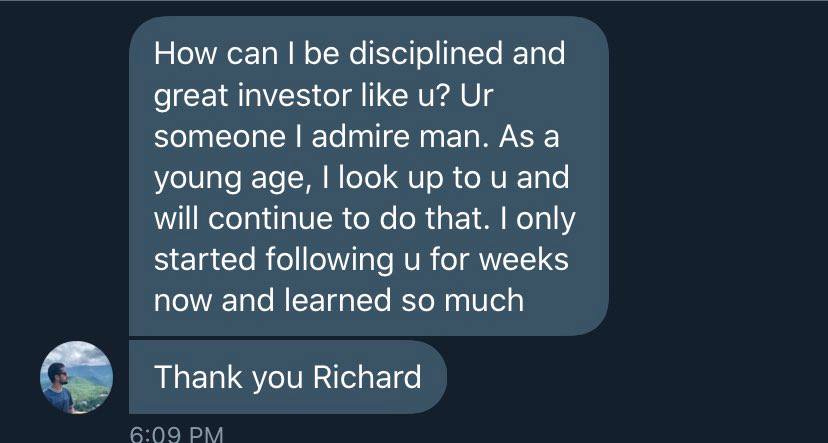

Receiving messages like these makes me so, so happy:

The difference that you can make in people’s lives if you are able to inspire and help them become better investors is greater than any monetary donation I could ever hope to make. “Give a man a fish and you feed him for a day; teach a man to fish and you feed him for a lifetime” has never been more true.

As for me, I managed to find what I was looking for and will be starting a new job at Saga with amazing mentors that I admire and trust.

Subscribe to get full access to the newsletter and website. Never miss an update.

Thank you for being so transparent. The most important thing I have learnt is doing what you do to provide value to others. The money and fame follow you once you get that.

Great story Richard! Like many people, I invested stocks at the wrong time and getting out too quickly and holding on to losing stocks too long. I rebooted this year in May 2020 and stumbled upon you on Twitter and others with similar investment philosophy like Chris Perruna, Puru Saxena, etc, and have had success so far. Keep up the good work! Much to learn from a young man like you!