Lessons after my 2022 Drawdown and Recovery

I revisit my learnings from 2022, provide an update on CVNA and CDLX's performance over the past year, and give a personal update

In 2022, my portfolio endured a nearly 80% drawdown. The experience was painful because it comprised the majority of my net worth and I was working at a fund that also had a drawdown.

During the past year, I changed jobs and worked at a family office in Canada where I learned a great deal and got exposure to private equity and value investments in Canadian small-caps.

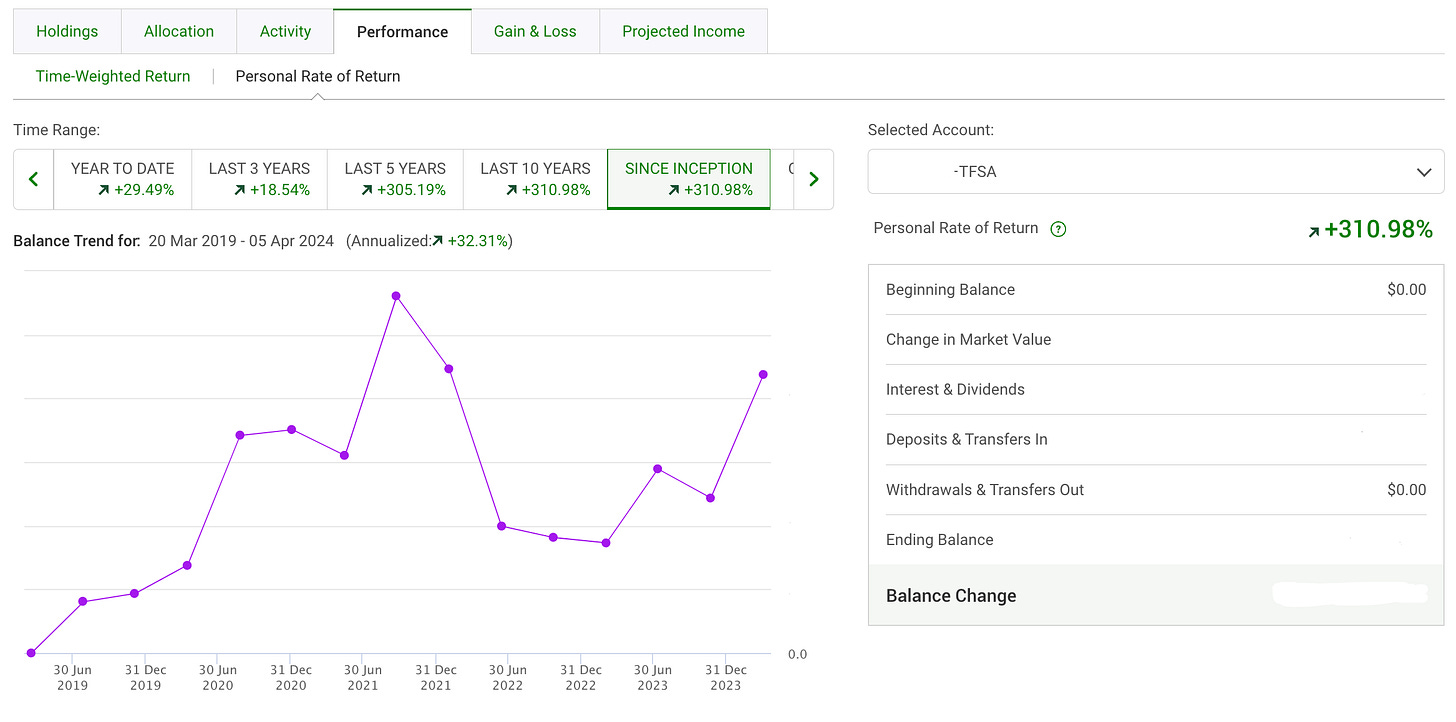

Despite what seemed like a significant loss, I’m pleased to report that just over a year later, my portfolio returns are well on their way to reaching my 2021 highs and my net worth has reached new highs, thanks to my decision to maintain my exposure to Carvana (18x’d since December 30, 2022) and Cardlytics (2.4x’d since December 30, 2022).

Note: I have accounts across multiple brokerages, this one is my model portfolio but has slightly outperformed due to the timing of contributions in other accounts

In my 2022 reflections post, I discussed the importance of not taking away the wrong lessons and the importance of thinking from first principles. In this post, I will revisit those lessons and try to explain what caused expectations to diverge so significantly from reality in CVNA and CDLX.

Revisiting My Lessons Learned

When I reflected on my 2022 performance last year, my takeaways were threefold. I acknowledged the importance of proper sizing and factor diversification, and the importance of balancing short-term considerations with long-term views. I continued to believe that CVNA and CDLX remained attractive opportunities with high expected values but acknowledged that I took on too much risk.

I did sell some CVNA shares after they reported Q3’22 because although management had cut SG&A in Q3, SG&A per unit actually increased because the cost-cutting wasn’t enough to offset the decline in units. I didn’t see a reason why they couldn’t right-size the business like they did in COVID and it was clear that they had at least a few quarters to do so, but I was worried that the business might enter a death spiral where they couldn’t cut costs fast enough without affecting unit sales. There was also the non-zero chance that Ally could pull the floor plan due to all of the negative press at the time, and it would be a mess for them if they thought Chapter 7 bankruptcy was a possibility.

However, I still believed that Carvana had options and that management would do whatever was necessary to keep the business as a public entity, so I replaced my sold shares with LEAPS which helped maintain a portion of my exposure. Fast forward to when Carvana reported Q1’23 in May 2023 and management’s cost-cutting efforts started to flow down to SG&A in a big way, and it was becoming clear that they had the capability to cut costs while maintaining units.

In July 2023, Carvana management announced it would initiate a debt restructuring and pledge their ADESA real estate, something I hypothesized in my 2022 reflections article in January 2023, which all but removed near-term liquidity issues. I added more despite the stock already rebounding significantly from the bottom. In hindsight, it would have been better to size up my position at this point rather than in 2022, and I would have still earned a great return if my long-term thesis was correct.

Cardlytics was also in a precarious position which caused the stock to decline 98% by March 2023. The previous management team had grossly overpaid for Dosh and Bridg during an acquisition spree in 2021, and left the balance sheet in a terrible state with profitability nowhere in sight. The Bridg acquisition had two earnout payments which were based on 20x and 15x growth in ARR from the acquisition to the first earnout and then the first earnout to the second earnout. JP Morgan, which made up over 40% of revenues, also acquired Cardlytics’s largest competitor, and people were concerned that their departure was imminent. Finally, Cardlytics continued to make little progress in improving its platform and Starbucks, which made up >10% of revenues, left.

In my Cardlytics write-up in 2022, I correctly hypothesized that JP Morgan Chase would not leave Cardlytics’ platform and that Cardlytics could easily cut costs to reach EBITDA breakeven given the capital-light nature of the business. Again, both of these beliefs played out in 2023. In June 2023, Cardlytics announced that JP Morgan had agreed to reduce its own revenue share as a percentage of billings through the end of the current contract term and along with cost cuts, this helped Cardlytics improve adjusted EBITDA margins from -15% in 2022 to +1% in 2023. Furthermore, Starbucks returned to the platform, likely due to the improvements made so far by the new CEO, as well as a leadership change on Starbucks’ end.

However, bankruptcy issues were not completely eliminated until very recently when Cardlytics announced the resolution of Bridg earnouts, a new partnership with Amex, and subsequently raised $200M by issuing $50M of equity and $150M through a convertible note. As with Carvana, I added to my position following these developments but in hindsight, I could have still waited for this outcome to happen first and missed the first 5x but ensured there would be no risk of permanent loss of capital. If I’m right, then I believe that Cardlytics can still earn an incredible return from here.

Overall, although I was right for the right reasons on why the market was overestimating the likelihood of bankruptcy for both businesses, I could have achieved better performance if I had focused more on the factors that drove short-term price performance and waited until it became clear that the business would survive before sizing up. Portfolio management and becoming a better stock analyst (in addition to business analyst) is something that I have continued to work on over the past year and I believe I’ve made a lot of progress in.

In my older write-ups, I tended to focus on in-depth business analysis, sharing as much as I could about each business and taking a 5+ year view on growth and valuation. In the future, I aim to focus on set-ups where there are quantifiable catalysts that will enable a re-rating over the next 12-18 months, which will help me to avoid thesis drift and manage risk. I believe that CDLX is one such example today, which I will dive into in later sections.

Anatomy of a Twenty-Bagger

The next question I want to reflect on is how the market got it so wrong on CVNA where it twenty-bagged in less than 16 months. You can argue that the current stock price is overvalued, but I don’t think it is possible to argue that the company has not only avoided bankruptcy but also proven its business model is profitable given sufficient volumes. 12 months ago, consensus EBITDA estimates for 2024 were -$171M and after CVNA’s Q4’23 report, they were $440M. That is a massive swing for a company that generated $1.7B in gross profit in 2023.

In December 2022, the stock dropped 50% on an article that creditors were forming a pact to hardball CVNA on negotiations, and that CVNA was talking to restructuring advisors. I continued to believe that management remained aligned with shareholders and that debtholders needed the management team to continue to run the business and not pledge the real estate behind their back. However, with the stock being down 99% at that point, it seemed like bankruptcy was all but assured.

There have been instances of previous large-cap companies dropping 99% and going on to recover like AMT and BKNG, but it seemed like such a possibility was remote given the sheer lack of examples. I believe that the market is efficient most of the time. Finding good opportunities is difficult, and there were thousands of talented analysts backed with perfect data covering Carvana. That begs the question of why such an opportunity existed. While I believe that luck certainly had a role, I believe that more than a few analysts would have come to the same conclusion in December 2022 that near-term bankruptcy was unlikely and that the option value alone was completely mispriced.

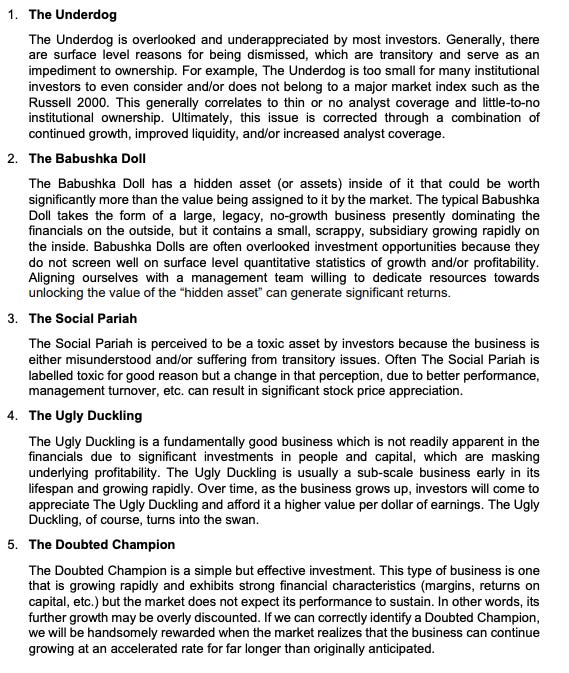

In order for other investors to sell you shares of a company for much lower than they are worth, there needs to be some kind of misunderstanding or structural barrier at play. I like the way that David Polansky from Immersion Investments frames his investments:

Under the above framework, I would characterize both CVNA and CDLX as being a Social Pariah and an Ugly Duckling.

One of the pervasive sources of market inefficiency is the fact that most investment funds optimize for marketability rather than absolute returns. Because allocators are removed from the day-to-day investment decisions, they do not have perfect information about a bet and are therefore only able to judge a manager based on the outcome of that bet.

For example, let’s say that consensus judged that CVNA had a 90% chance of bankruptcy and a 10% chance of surviving. If I judged that CVNA had a 90% chance of surviving and a 10% chance of bankruptcy and I was correct but a left tail event still happened and it zeroed, then it would be a potentially career-ending move depending on the amount I bet on it. Even the very possibility that it could zero in the first place might preclude me from ever owning it, despite how attractive the risk/reward may be.

Furthermore, if my bet is successful, then it will likely still be difficult to convince prospective LPs to invest as they might continue to view the outcome as luck-driven and not replicable. So with severe reputational risk on one hand and only modest rewards on the other, it is no surprise why managers who are looking to optimize for asset-gathering will not even bother to look into such investments.

To add further fuel to the decline, funds that already owned CVNA in size were seeing significant redemptions which forced them to liquidate, which pushed the price down further and forced even more funds to liquidate, etc. Tiger Global liquidated their position in CVNA when it was down over 90% and fired the manager associated with it. T Rowe Price, once the holder of over 15% of CVNA’s float capitulated and sold their entire position in Q4’22.

Even I personally grew worried about continuing to publicly be bullish on CVNA near the tail end of the decline given that I was looking for a new role at the time. However, I acknowledged that this dynamic existed and was irrationally pushing the price down given the deluge of forced sellers and lack of buyers. This resulted in a 99% drawdown and created a truly unique buying opportunity for long-term investors who still had the capacity to add.

Both Carvana and Cardlytics were also Ugly Ducklings as cursory looks at their financial statements over the last few years seemingly reveal leveraged, cash-burning business models with ill-timed acquisitions followed by dilutive raises.

However, I believe both business models’ true earning power will only become apparent at scale due to the amount of fixed costs associated with building up their platforms and competitive advantages.

Carvana sold just 312K units in 2023 but generated all-time-high gross profits per unit that were also above traditional brick-and-mortar dealerships. They currently have reconditioning capacity for up to 1.3M retail units today and with ~$1B in additional investment in ADESA, they can get up to 2.3M units.

With Carvana currently utilizing just a fraction of its overhead capacity, it is obvious that SG&A per unit will continue to fall as volumes grow, thus allowing it to further increase EBITDA per unit, potentially far above $2K per unit at 1.5M units based on what Carvana has previously achieved and guidance that management has put out. CVNA is currently trading at just 7x EV/EBITDA at that scale. It is clear that Carvana can become a much more valuable business than it is today, the only question is how long this will take. The company appears to be on the path to re-accelerate growth today, with alt data showing the company is on track for a significant beat on units in Q1’24.

In the past, I have written multiple threads on why I believe Carvana is able to deliver a better value proposition in terms of price, selection, and convenience than any of its peers, while also doing it more profitably, and why that gap will continue to widen over time. I continue to believe that they can scale to over 3M units in a 40M used car market in the US over time, and after industry conditions during the last two years, their lead has only grown.

Cardlytics also has incurred high fixed costs in building up its platform but should see significant operating leverage over the next few years as new banks and advertisers are onboarded at a low incremental cost. For example, Cardlytics recently announced a partnership with Amex. While Cardlytics traditionally paid bank partners revenue share amounting to 1/3 of billings, I believe that Amex will not require any revenue share due to the wording of the 8K; this is supported by the fact I’ve heard they do not already charge advertisers revenue share. This means that gross margins for Amex could be >90% compared to 45% for other banks. I believe this is an important insight that was initially missed by most investors.

I believe Amex will bring 20M to 30M additional MAUs to CDLX’s platform (currently at 168M MAUs). If we assume that there are 25M MAUs that come in at the same ARPU as CDLX has for everyone else (which I believe is highly conservative because Amex users spend 3x more than Chase) then that means $50M of incremental revenue at $2 ARPU or $45M of gross profit. The substantial majority of this should drop to the bottom line, given management indicated there are few costs associated with onboarding a new bank.

Cardlytics’ 2023 full-year revenue was $309M so they can grow 16% alone from Amex. If we assume adjusted EBITDA of $40M then Cardlytics’ adjusted EBITDA margins can improve from 1% to 11% just from cross-selling revenue from Amex. With the possibility of upcharging Amex’s existing merchant base, and additional optionality from signing other banks, lowering revenue share with existing bank partners, and growing ARPU from their new user experience, then it’s not difficult to see how revenue growth could inflect very quickly, with substantial margin expansion.

If Amex plays out how I expect, I wouldn't be surprised to see the company print at least $90M of EBITDA in 12-18 months, which would mean it’s trading at ~10x EV/fwd EBITDA today (pro forma for recent dilution and Bridg earnout payment), a cheap multiple for a monopoly, capital-light business that can grow at an >15% CAGR for a long time. It is my top idea right now as I believe the stock has been de-risked and I believe the stock can double over the next 12-18 months as the core business re-accelerates and the market appreciates the potential of the Amex deal.

I would recommend you subscribe to Indra's Thoughts and

and follow them on Twitter for in-depth, active coverage of both CVNA and CDLX. We’ve compared notes frequently with each other over the past two years and they both put out some of the best research on Twitter in my opinion.There is No “Right” Strategy

I find that investors’ philosophies tend to correlate with the market environment that they grew up in. Investors that were scarred by the Dot Com Bust might have avoided technology stocks and investors that were scarred by the GFC might have held too much cash and overweighted macro factors. Both have proven to be costly decisions throughout market history.

Despite terrible performance in 2022, I noted that taking away the wrong lessons could end up being even more costly over the long term and at the time, it seemed like the lesson was to avoid unprofitable growth stocks altogether. While it is perfectly understandable that many investors choose to avoid these stocks because forecasting their futures can prove to be too difficult, such widespread generalizations can also create significant opportunities for investors who are willing to look past the headlines and view each situation from a first principles basis.

By all means, the base rates of success are not high for companies that are unprofitable, dilutive, and leveraged which could all be factors used to describe CVNA and CDLX. Of course these are not attractive qualities; however, these negative factors must be judged in balance with positive qualities.

When I started investing, I focused on growth companies, specifically in SaaS. I saw the most opportunity to generate above-average returns as I believed durable growth was likely to get mispriced. Although I initially did well, in hindsight, I should have started in traditional value investing, looking at companies trading at cheap multiples relative to current profits and returning capital to shareholders. You can still end up owning value traps, but you need to make fewer assumptions and there is a higher margin of safety.

During the past year, I had the opportunity to work alongside a talented small-cap manager focused on the Canadian market. I believe retail investors have a structural advantage in small caps as there is limited opportunity to deploy large amounts of capital, so they tend to be more inefficient. Of course, many of these businesses are also of lower quality, but there are also gems in the rough that would almost certainly be priced higher if there were more eyes on them.

I continue to believe that long-term growth investing in “compounders”, or companies that grow at above-average rates for a very long time, is a great strategy to beat the market but it is also very difficult to predict what the future will look like 5 to 10 years down the road and can result in blowups if those expectations don’t materialize when you’re buying a stock at a high multiple on sales.

During 2020 and 2021, I owned a lot of companies that went on to perform very well, such as CrowdStrike, The Trade Desk, and Datadog. However, I also had a few bad picks such as Teladoc and GoodRx.

I’ve written extensively about where I got GoodRx wrong in my 2022 reflections article, but essentially the TAM was a lot smaller than I had thought, and the value proposition hurt pharmacies which eventually backfired. With Teladoc, I still believe that my idea for a healthcare system centered around preventative care powered by remote monitoring and AI is where the system will eventually end up, but I was extremely early and there was a lack of results that indicated Teladoc would be the eventual winner.

I believe that Carvana and Cardlytics are different because they already have proven value propositions, proven unit economics, and operate within large and well-defined industries.

People will likely continue to buy used cars 10 years from now, and I believe that more people will choose to do it online through Carvana due to significant advantages in price, selection, and convenience. I believe that Carvana has proven they can scale with improving unit economics in early cohorts and can replicate that across the company, and that they have significant competitive advantages that will only become more powerful as they scale.

Likewise, I believe that people will continue to use their banking apps in 10 years, and they will still want to look for a good deal. I believe that advertisers will gravitate towards the platform with better and more measurable return on ad spend, and that Cardlytics can scale ARPU significantly past the $3.00 ARPU they achieved at their best bank partner already, given improvements made to the UI/UX. I believe that despite not owning the user directly, Cardlytics has already proven the leverage they have over their ecosystem after their largest bank partner agreed to lower revenue share due to the win-win nature of the relationship.

It is for these reasons that I believe that despite not clearly having the traditional attributes of a “high quality” business, both CVNA and CDLX will evolve to become viewed as high quality and that the assumptions required to get there are relatively simple. Furthermore, I believe that there exists a substantial delta in sell-side expectations for both CVNA and CDLX over the short to medium term. With CDLX especially, I believe that the launch of the Amex deal presents a substantial near-term catalyst that is largely not priced into the stock today.

Posting on Twitter

I find Twitter to be a very underrated investment tool, largely due to the network of like-minded investors that I was able to meet and form long-term relationships with. However, I regret being as public on Twitter as I was; to be a good investor, you have to be an independent thinker, whereas if you want to optimize for success on Twitter, you must follow the trend and talk about popular stocks.

I was fortunate to have developed a large following in a relatively short period of time by openly sharing my thoughts and portfolio. On the way up, it felt good to be able to receive so much validation from strangers and I became focused on growing my following and getting more likes, even though I wasn’t making any money from it.

However, as I continued to post my results on the way down in 2022 in order to maintain transparency, I started to receive a constant amount of hate. I had never blocked anyone before, and initially, I welcomed counter-arguments and constructive criticism. But eventually, it started to become personal attacks, and everything I said would be taken out of context or framed negatively in an attempt to boost engagement.

Most investors, even legendary ones like Munger, who was down over 53% in the 1973-1974 bear market, have had near blow-ups in their earlier days. Though I don’t believe I hold a candle to Munger, I have no doubt that if he reported his quarterly performance on Twitter at the time, then he would have been ridiculed as well. If you own Social Pariah stocks like Carvana, it should be expected that you will receive a fair amount of hate, but I underestimated how much it affected my psyche, given everything else that was going on at the time.

Final Words

In hindsight, I am happy to have gone through 2022, as I believe that it challenged me in ways that I had never expected, and I am a better investor and a stronger person for it. The drawdown also gave me the opportunity to significantly lower my cost basis on my favorite names, which seemed delusional at the time, but I look back on it as a gift given that these businesses were not permanently impaired and actually came out stronger positioned.

Thanks,

Richard

I remember nasty 2022 as well , but still not convinced of $CVNA business model.

Personal experience ot doing my cars trade and sale at Carmax was way better and more efficient than Carvana . I do trade Carvana short , golden time at $HTZ trades over the early times taught me one thing , car industry is very complex and not reliable, look at $F for decades it was like 9 bucks , forever loser.

Your post is good as reminder to me again not to marrying stocks , except for dividends over 9% , and just trade in trend . Never get pissoff and try get even with losing position.

Good luck with employment, will pass along to my sources about your honest nature and great experience.

Regards ,

Alex

Thank you for sharing this Richard, and happy to see you writing again!