GoodRx: The Frontdoor to Healthcare

By empowering health consumers to access affordable healthcare, GoodRx is becoming the first stop on any healthcare journey.

Investment Thesis

GoodRx is a health tech company focused on making healthcare affordable through its prescription drug pricing comparison and savings platform and its telemedicine offering

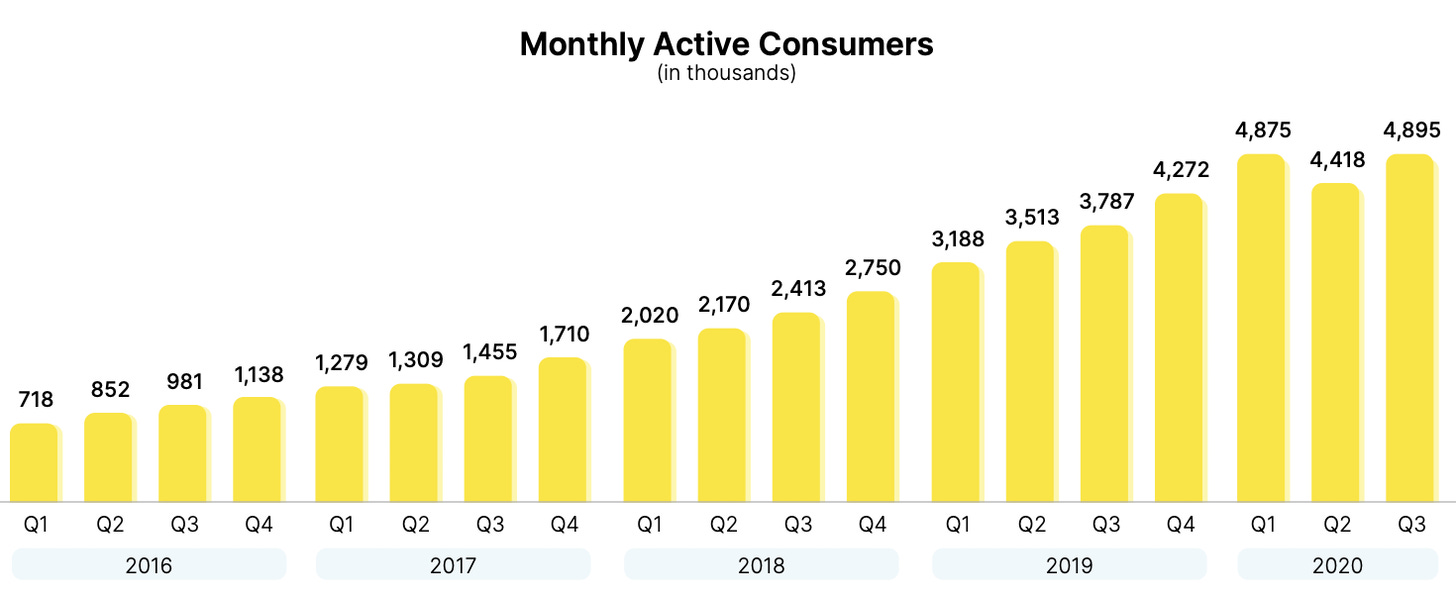

They are the category leader in a massive, untapped market with over 4.9M monthly active consumers

Their competitive position is secure as they continue to gain bargaining power over PBMs with scale and source cheaper pricing through data network effects

Amazon’s entry has created a compelling entry point as user growth begins to normalize post-reopening

Introduction

Why do Americans spend twice as much per capita on healthcare compared to citizens from other OECD countries but rank among last in numerous quality of care rankings such as obesity or chronic disease? Why is it that affordable healthcare coverage still remains out of reach for over 10% of Americans, which led to ~66% of all personal bankruptcies between 2013 and 2016? Why should 64% of Americans make the decision to risk their health by avoiding or delaying medical care because of the cost?

Doug Hirsch and Trevor Bezdek asked themselves the same questions and founded GoodRx as the answer. Today, 4.9 million Americans a month rely on GoodRx in order to find affordable healthcare and it has saved a cumulative $25 billion since 2011. When 70% of consumers still do not know that they can price shop for their prescriptions, I think GoodRx is just getting started.

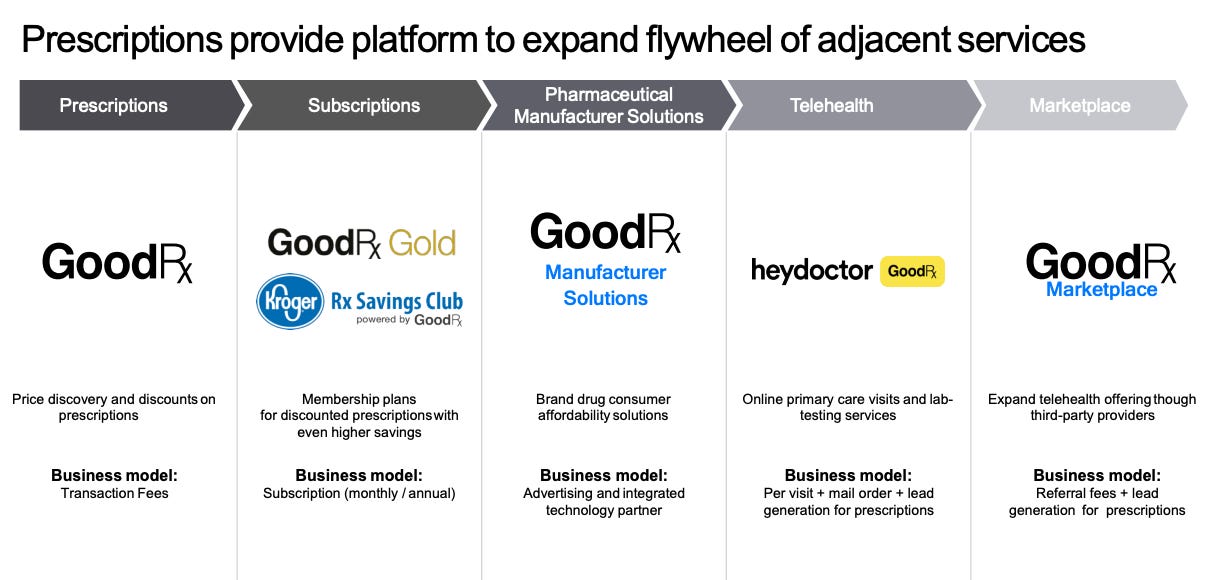

Business

GoodRx started out as a price comparison tool for prescriptions and that remains at the core of what they do today (~90% of total revenues); however, they’ve been able to leverage the dominance they’ve achieved in this market to expand into adjacencies including subscriptions, pharmaceutical manufacturer solutions, and telehealth.

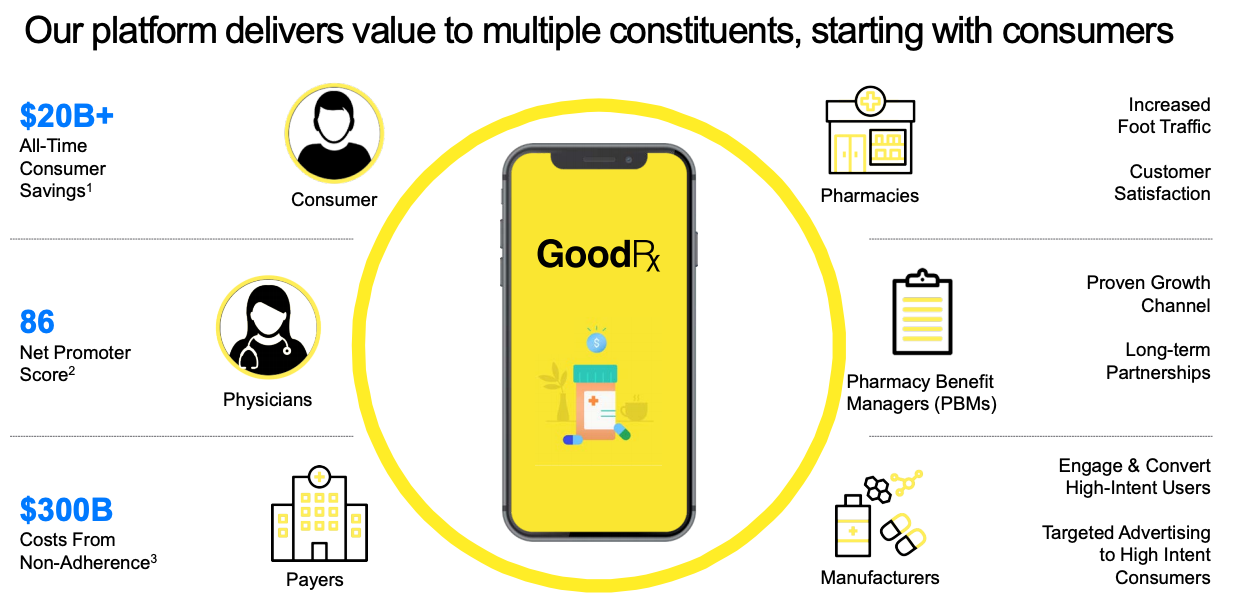

Source: GoodRx Investor Presentation

Prescriptions

Through GoodRx’s app or website, consumers access coupons or sign up for a discount card which significantly reduces their cost of medication (average discount to list price is >70%). GoodRx claims that consumers are 50-70% more likely to afford and fill a prescription and thus follow through with their prescribed treatment plan due to its offering.

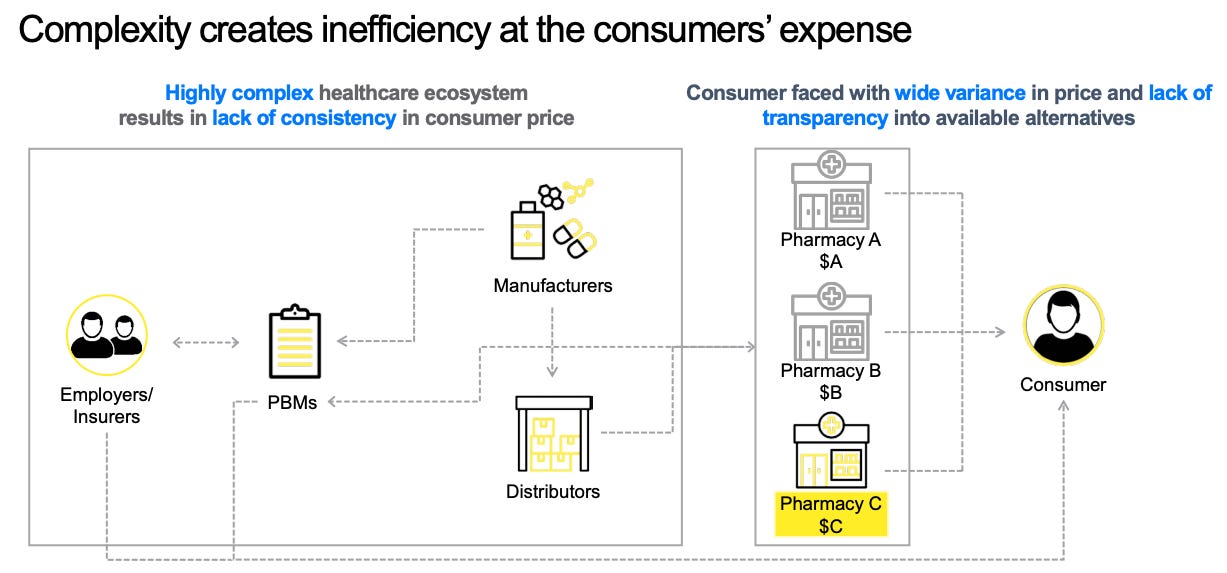

In order to understand where these cost savings come from, we need to take a step back and understand how drug pricing works. Pharmacies establish Usual and Customary (U&C) prices for prescriptions which is the price that uninsured consumers are asked to pay. These often differ dramatically between pharmacies and are usually significantly inflated. Pharmacies do this because they have contracts with Pharmacy Benefit Managers (PBMs) which themselves help insurance companies manage drug costs.

In these contracts, PBMs agree to pay the pharmacy the lesser of:

The Average Wholesale Price (AWP) minus a percentage plus a dispensing fee

The Maximum Allowable Cost (MAC) plus a dispensing fee

The pharmacy’s U&C price

AWP is the price that the pharmacy pays to buy the drug from the wholesaler plus a markup of usually around 20%. MAC is the maximum price that a PBM will pay for generic drugs or brand name drugs with generic versions available. PBMs have free reign over determining these prices, thereby forcing pharmacies to acquire drugs at more favourable prices, while using another higher set of prices when they sell to their clients, pocketing the difference. This leads to artificially high U&C prices which have to be set above the maximum allowable reimbursement from any payer so as to not potentially miss out on profits.

Source: GoodRx Investor Presentation

Since the PBM industry is itself disjointed with multiple MAC lists each with different drugs and prices, it becomes impossible to adjust U&C prices slightly above every single MAC price. Thus, if a pharmacy wanted to be competitive in the cash market, they would need to sacrifice their reimbursement margins which is a terrible trade-off as it forms the vast majority of their revenue, and PBMs are incentivized to lower MAC further overtime which further makes such a strategy untenable.

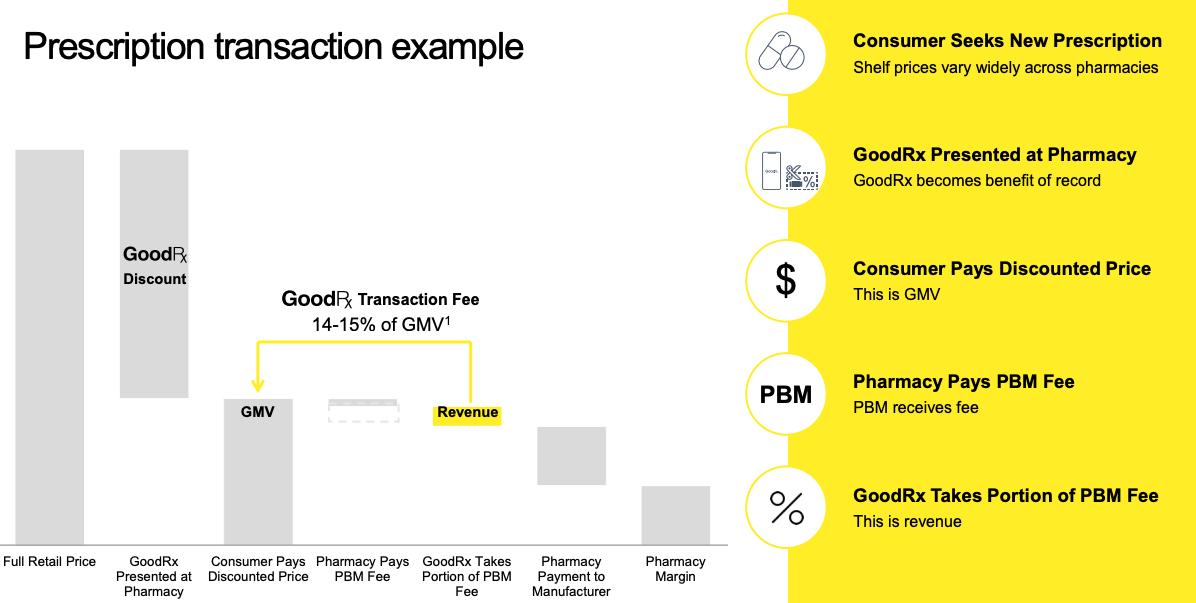

So with that in mind, PBMs are able to negotiate “discounted pricing” via their MAC lists which end up being significantly lower than U&C prices. The pharmacies that are under the PBM’s network accept these prices to access the plan’s members. GoodRx partners with PBMs like Express Scripts and OptumRx that share their negotiated rates. For uninsured consumers, the value proposition is clear as they are no longer forced to pay the artificially high U&C prices. For insured consumers, which form ~74% of GoodRx’s userbase (34% Medicare, 4% Medicaid, and 36% commercial), since MAC rates can vary dramatically across PBMs, 40% of the time for the top 100 drugs, GoodRx is cheaper than insurance co-pays. In both of these cases, PBMs benefit from accessing previously out-of-reach uninsured consumers as well as saving money by having consumers pay the entire cost out-of-pocket. The pharmacy collects a per-prescription fee which is paid to the PBM which then shares it with GoodRx for finding the customer, leading to a take rate of 14-15% on generics. This has steadily increased as more volume is transacted through GoodRx, and I’d expect this rate to continue to remain stable as there are no competitors that come close to GoodRx’s scale.

Source: GoodRx Investor Presentation

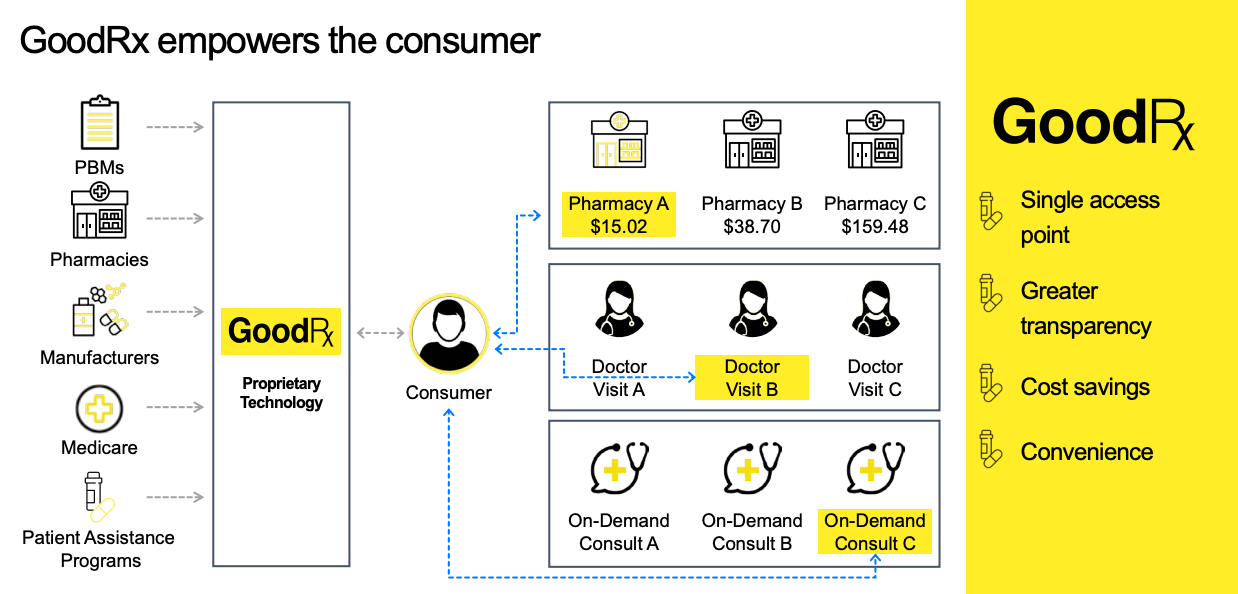

Each day, GoodRx aggregates 150 billion prescription data points from PBMs, pharmacies, pharmaceutical manufacturers, patient assistance programs, and Medicare to always find the best prices for consumers. GoodRx’s first-to-scale advantage is a big moat here, since they maintain the largest database of pricing information, they are able to consistently find lower prices than competitors which in turn, attracts more consumers and more PBMs, which contribute more data to drive lower pricing.

Source: GoodRx Investor Presentation

The value proposition to the consumer is clear, they are able to easily compare prices across over 70,000 pharmacies (nearly all in the US) and access GoodRx coupons for free through its user-friendly platform. Once a code is used, it’s registered in the pharmacy’s database and is automatically applied for future refills and in many cases, additional prescriptions. This introduces predictability to GoodRx’s revenue base as over 80% of its transactions are from repeat activity (majority of prescriptions are for chronic medication) as well as driving future business to the pharmacy. GoodRx boasts an incredible NPS of +90 with consumers.

Source: GoodRx Investor Presentation

The benefit to PBMs is also evident as GoodRx is oftentimes their only significant direct-to-consumer channel, where they offer their network rates to GoodRx’s userbase and earn a share of the per-prescription fee. As a result, GoodRx has never lost a PBM client.

GoodRx claims to benefit pharmacies by reducing the 20-30% of prescriptions written that are not filled due to cost, and increasing foot traffic and the likelihood of consumers purchasing high margin non-pharmacy items. Although in practice, pharmacies’ margins get squeezed and even turn negative in some cases, and they are forced to pay the administrative fee per transaction when the customer may have visited their pharmacy regardless. This has led some pharmacies to attempt to disintermediate GoodRx by offering the discounted price directly to consumers through local coupon programs and not paying the fee. However, their PBM contracts forbid this, and it’s hard to see this taking off at a widespread level before PBMs intervene; ultimately, it’s the PBMs and GoodRx that have the bargaining power because they control the demand. This also seems to mostly happen at independent pharmacies, which form around 37% of the total.

Subscriptions

Another area where both pharmacies and GoodRx benefit is in driving repeat visits with GoodRx even partnering with Kroger, the fourth largest US retail pharmacy chain, to provide co-branded subscription products such as Kroger Rx Savings Club. Consumers pay an annual fee of $36 for individuals and $72 for families which is shared with GoodRx and they can access even lower prescription prices at all Kroger locations including over 100 common generics for free. GoodRx also partners with pharmacies to drive increased flu vaccinations which they’ve expanded from two to eight chains this year.

GoodRx also offers their own subscription savings program called GoodRx Gold where frequent users of the app can again pay a $6 monthly fee for individuals and $10 for families to get over 1,000 prescriptions for under $10, as well as other features like free mail order delivery, refill reminders, and price alerts. These customers are substantially more profitable than prescription consumers with two times the revenue contribution in year one and the amount of subscribers has grown 15x from the end of 2018 to June 30, 2020.

Pharmaceutical Manufacturer Solutions

GoodRx is increasingly moving into brand medications which formed 80% of prescription spend in 2019 by partnering with pharmaceutical manufacturers that pay them to integrate their affordability solutions such as co-pay cards, patient assistance programs, and more for brand medications. Since brand medications are around six times more expensive as generics and coverage is complicated, GoodRx is an important channel to reach consumers as brand drugs form 20% of searches on its platform. It is reasonable to expect a lower take rate, however, as margins on brand medications are significantly lower than generics.

Telehealth

This is all great but as with every DTC business, acquiring consumers cost-effectively is a challenge as CAC will continue to rise over time and Google becomes the real winner. However, GoodRx is able to circumvent traditional marketing channels and acquire customers at a fraction of the cost that other DTC digital health companies like Hims & Hers do by partnering with providers. In a recent survey, GoodRx found that 68% of providers have recommended GoodRx to their patients and 17% of its website visitors are healthcare professionals. Improving affordability leads to improved medication adherence which leads to better outcomes and lower overall costs. Non-adherence is estimated to result in a patient death every four minutes in the US and can cost up to $300 billion per year in incremental healthcare expenses. When consumers use GoodRx, they are 50-70% more likely to afford and fill a prescription and thus follow through with their prescribed treatment plan, which reduces the burden on health systems and emergency rooms, so providers are very happy to recommend GoodRx and have an NPS of +86. In order to facilitate this, GoodRx provides physical cards for in-office use and launched a GoodRx Pro app (has an App Store rating of 4.8/5.0) for healthcare professionals to facilitate electronic prescriptions. GoodRx also works with leading electronic health record (EHR) providers to integrate its pricing tool directly into prescribing workflows.

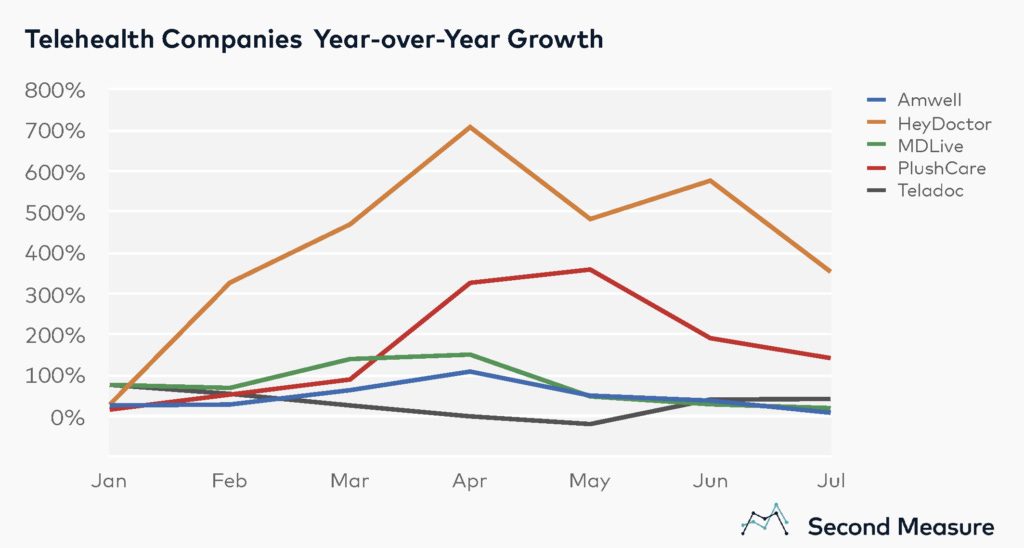

This win-win-win for consumers, PBMs, and providers has culminated in an unmatched value proposition that has propelled GoodRx to become the second most popular medical app on the App Store, a testament to being the “front door of healthcare”. Furthermore, GoodRx is increasingly leveraging this massive userbase by expanding into adjacent markets. One such example is their foray into telemedicine in 2019 with their acquisition of HeyDoctor. Customers are paired with either an in-house provider or one from the various physician networks that GoodRx contracts with who cover 25 conditions with visits starting at $20 across all 50 states. Recently, GoodRx paired their prescription offering with HeyDoctor to offer discounted prices on drugs that can be fulfilled either through mail order (processed by a third-party partner) or a retail pharmacy. Since launching this feature, 10% of HeyDoctor consumers have taken advantage of GoodRx codes and there is room to grow as 20% of consumers who search for medication on GoodRx do not have a prescription. This direct-to-consumer telemedicine offering competes directly with digital pharmacies like Hims & Hers and Ro, as well as larger telemedicine companies like Teladoc or Amwell. Although HeyDoctor only sees a fraction of the visits that established competitors do, it has been growing significantly faster, demonstrating the value of GoodRx’s unique position as the leading prescription drug price comparison platform.

Source: Second Measure

Lastly, GoodRx also operates a Telehealth Marketplace which allows consumers to access third-party providers of telehealth and lab tests, covering 150 conditions and offering transparency on pricing, services, and prescription delivery options. GoodRx again earns a fee here from referrals and partners with some providers to allow consumers to use its prescription offering post-visit.

Market Opportunity

As I’ve touched on in my Teladoc thesis, the healthcare industry has historically been resistant to disruption because it doesn’t operate as a free-market should. This is especially evident in the pharmacy industry for cash-pay customers. Because pharmacies’ pricing is largely dictated by payers, since that’s where most of their business is derived from as I explained in the previous section, they are not able to introduce competitive pricing for the small base of cash-pay consumers. This misalignment has created opportunities for new players like Hims & Hers, Ro, or GoodRx to effectively serve this segment with a unique counter-position. Digital pharmacies where consumers without insurance can set up on-demand telemedicine consultations with providers and get their prescriptions delivered introduce affordability, convenience, and transparency that existing players can’t match.

Whereas Teladoc is empowering health plans, self-insured employers, and health systems to reduce costs and improve outcomes with its virtual care platform, GoodRx is going directly to consumers and making their healthcare more affordable. Cost is a major factor in why 20% to 30% of prescriptions are left at the pharmacy counter, and the resulting non-adherence results in a death every four minutes in the US and cost up to $300 billion per year in incremental healthcare expenses. Americans want change, with 62% saying that healthcare is the most or second most important issue; however, although drug pricing has consistently been a topic in every US election, little progress has been made.

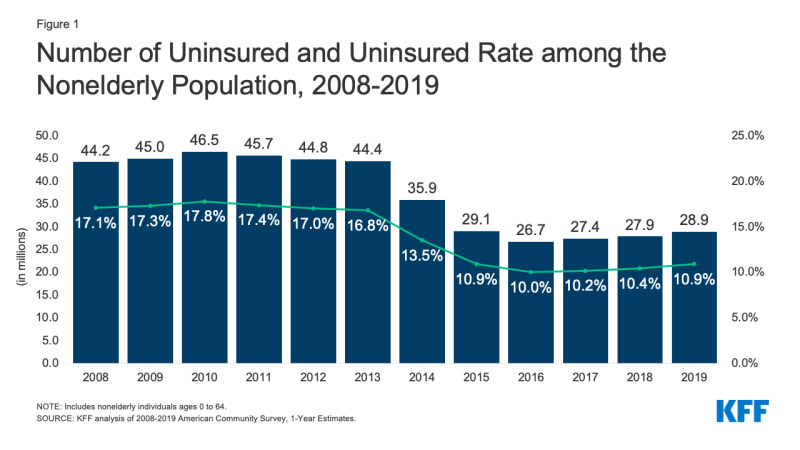

In 2017 alone, Americans spent $334 billion on prescription drugs, up 41% from 2007, significantly outpacing other countries. Furthermore, consumers are taking on a larger burden of the cost, with the average premium for family coverage increasing 54% over the past decade, significantly more than either workers’ wages or inflation. And although the implementation of the Affordable Care Act (ACA) in 2010 led to a significant increase in Americans covered by insurance, that trend has reversed in recent years. In 2019, 10.9% of Americans under 65 were uninsured, and 73.7% of them cited a lack of affordability as the main factor.

Source: KFF

It’s clear that Americans want solutions but awareness, in general, has been low due to a significant lack of transparency. As previously mentioned, according to GoodRx, 70% of consumers do not know that the price of a prescription can vary widely across pharmacies, sometimes by over 100 times for the same medication! Common healthcare services and surgical procedures can also vary greatly in price, with differences of up to 39 times for the same service within similar geographies. Hemant Taneja, a managing director at the VC firm General Catalyst touches on this in his book UnHealthcare. It’s that misalignment of incentives where who decides the treatment, who pays for it, and who benefits are all different. This has resulted in an utter lack of transparency for consumers that is unique to healthcare. Why can we price shop on Amazon for something as inconsequential as a smartphone case when we can’t do the same for provider visits or essential medications?

Through its prescription price comparison tool and telehealth marketplace, GoodRx is bringing prices down across the board and creating the same consumer-focused experience that we’ve come to expect in every other industry. This is a massive opportunity no matter how you frame it, in fact, GoodRx advertises an $800 billion TAM.

Source: GoodRx Investor Presentation

In reality, though, this figure seems a bit inflated as GoodRx cannot realistically capture the entire market. Let’s calculate the serviceable addressable market.

Prescription Opportunity

According to CMS, the US prescription market is expected to reach $360 billion in 2020, with an additional $164 billion in unfilled prescriptions. However, 20% of prescription spending was for generics in 2019. Therefore, we can imply the generics market is worth $105 billion and brand $419 billion. It is reasonable to expect that GoodRx can capture the unfilled prescription opportunity as it claims consumers are 50-70% more likely to afford and fill a prescription with its platform. However, branded medications have historically only formed 5% of GoodRx’s revenue base. Applying GoodRx’s 14-15% take rate to the $105 billion generics market leads to a $15.75 billion opportunity. Generic spend is expected to grow at an 11% CAGR through 2024. GoodRx also charges for a subscription offering through GoodRx Gold, which is $5.99/month for individuals. Since the uninsured population would benefit the most from the discounts, let’s assume that GoodRx can potentially capture the 28.9 million uninsured Americans, leading to another $2.08 billion.

Pharmaceutical Manufacturer Solutions Opportunity

Pharmaceutical manufacturers spent $30 billion on medical marketing and advertising in the US in 2016. The majority of it went to health professionals in paying for free drug samples but consumer-focused ads are growing significantly faster, accounting for one-third of overall spending (from 12% in 1997) or $10 billion. This is the market that GoodRx can hope to capture.

Telehealth Opportunity

It’s no surprise that telehealth has seen a significant boost from the pandemic, with consumer adoption tripling from 11% in 2019 to 46% as of April 2020. In the US, there were 879.6 million outpatient visits in 2018, and McKinsey estimated that 24% of these visits could be delivered virtually, leading to 211.1 million visits a year. If we multiply that by HeyDoctor’s $35 average visit fee, then we get a market size of $7.39 billion. It should also be considered that GoodRx gets referral fees with its telehealth marketplace.

This all leads us to a serviceable addressable market of $35.2 billion which is a far cry from the $800 billion TAM that GoodRx advertises but still significantly larger than most companies.

Competition

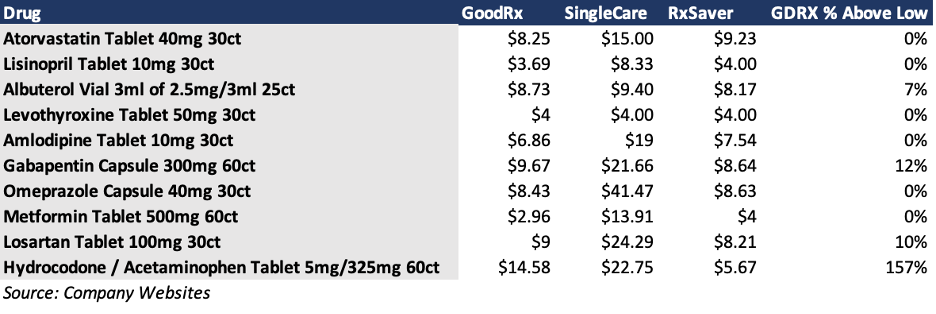

There are numerous other prescription price comparison tools; however, GoodRx is by far the largest with SingleCare and RxSaver as its closest competitors. GoodRx’s dominance is clearly evident when looking at App Store rankings: GoodRx is second, SingleCare is 24th and RxSaver is 26th as of the time of writing. RxSaver by RetailMeNot, like GoodRx, partners with a number of PBMs whereas SingleCare is a wholly-owned subsidiary of another PBM, RxSense. SingleCare’s vertical integration means that they negotiate directly with pharmacies and don’t have to share their fee with third-party PBMs; however, this also means they only work with about half the number of PBMs as GoodRx.

When comparing discounts for the top 10 most popular prescription medications on GoodRx in New York City, GoodRx’s pricing advantage is clear, with lower prices than both SingleCare and RxSaver for 6 of the top 10 drugs.

There are also various PBM-owned prescription savings programs such as Optum Perks by Optum, ReducedRx by CVS, or InsideRx by Express Scripts, but because they are limited to their own networks, they are not able to offer the same levels of savings. GoodRx’s massive userbase means they have the most bargaining power and hence can negotiate better margins and work with more pharmacies and PBMs. Pharmacies also compete directly against GoodRx with their own savings programs but again, they are limited in the discounts they are able to formally offer because lowering U&C prices would encroach on the vast majority of their revenue base.

In terms of its telemedicine offering, HeyDoctor did over 1,000 visits a day in Q2, which is far cry from the 2.8M visits that industry giant Teladoc processed in the quarter. However, GoodRx has a unique relationship with patients. On average, Americans see their primary care physicians about four times a year whereas they visit a pharmacy about 35 times. The frequency at which consumers depend on GoodRx’s app means that there is a significant opportunity to bolt on additional offerings to become the one-stop-shop for healthcare. I thought it was smart for them to launch a telehealth marketplace back in March 2020 as that industry, like with pharmaceuticals, is increasingly fragmented with over 260 providers in the US. Consumers can depend on GoodRx to help them parse through an increasing number of options and get discounts on some services while telemedicine providers see it as an important channel for customer acquisition. I mentioned in my Teladoc thesis that I see telemedicine largely as a commoditized service, and GoodRx’s entry will no doubt continue to pressure per-visit margins down over time as they’ve done with prescriptions. I believe that the larger providers are somewhat insulated from this and especially Teladoc with its Livongo acquisition.

Lastly, GoodRx competes against digital pharmacies. This could be the likes of Amazon Pharmacy or Capsule which both offer free delivery after patients send them their prescriptions or integrated players like Hims & Hers or Ro where patients can chat with providers and get prescriptions written for them and regularly delivered in discrete packaging.

I think that GoodRx has a superior competitive position vis-à-vis both of these players. Capsule delivers same day but only in New York City, Boston, Chicago, and Twin Cities. Hims & Hers and Ro benefit from vertical integration and their main selling point is the convenience of seeing a doctor via telehealth and their unique branding. However, they are increasingly competing on price to attract customers. Ro, for example, recently launched Ro Pharmacy which is similar to GoodRx Gold in that consumers pay $5 per month per medication (for over 300 generic medications in 23 states). This is disruptive to traditional pharmacies that can’t afford to compete on U&C pricing.

Where GoodRx wins is by offering lower prices, higher variety, and cheaper and more sustainable CAC. Instead of building out their own distribution networks, GoodRx can just leverage their relationships with multiple PBMs that compete with each other and drive down prices for GoodRx’s userbase while offering the most diverse array of medications. They will always have the advantage in users which they can then cross and upsell into, aided by their provider relationships, making for more attractive unit economics.

Amazon has made a lot of news lately when they announced Amazon Pharmacy, an extension of their 2018 PillPack acquisition, where Prime members can now receive free two-day delivery and five-day delivery for everyone else. They also announced a prescription savings benefit where Prime members can save up to 80% discounts on generics and 40% for brand without insurance at over 50,000 pharmacies including Rite Aid, CVS, Walmart, and Walgreens. They are partnering with InsideRx (Express Scripts) which also works with GoodRx to provide the benefit.

The Pharmacy offering isn’t likely to affect GoodRx significantly, as mail order only forms around 4.9% of prescriptions. COVID-19 had some brief impact with mail-order prescriptions rising 21% YoY during the last week of March to bring their share to 5.8%, but this bump was short-lived. People can even use the GoodRx coupons at Amazon Pharmacy, just like at every other pharmacy.

However, the discount card should be considered a direct competitor. Doug tried to assuage investor concerns by pointing out that regulations require that Amazon offer a discount card in order to publish drug prices and its main focus is on its mail order pharmacy. In addition, because Amazon is only working with a single PBM, it is unlikely they will be able to match GoodRx’s discounts in the near term. GoodRx has access to 13 PBMs competing against each other to offer their cash network rates so it has a higher chance of finding cheaper prices. Retail pharmacies and PBMs will also likely be reluctant to work with Amazon, similar what happened after they acquired PillPack which might push them closer to GoodRx.

As I mentioned in my initial Twitter thread, I believe the market overreacted to the announcement and discount cards and mail order aren’t new and Amazon will face significant hurdles in adoption with both. Although Amazon might be able to overcome its pricing disadvantage through its scale, it would be premature to count GoodRx out. In the end, Amazon’s entry might just broaden the market for everyone; Doug has previously said that their real competitor is the 70% of consumers who don't realize that prices differ across pharmacies.

Competitive Advantages

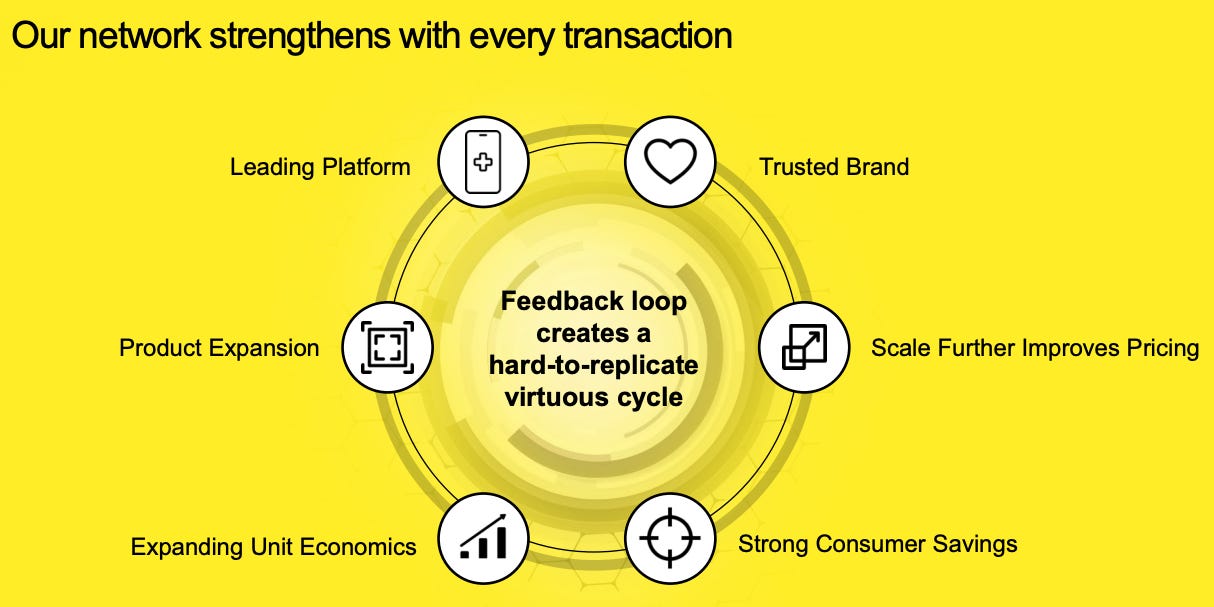

Source: GoodRx Investor Presentation

Network Effects

GoodRx’s larger userbase means that they become a more attractive partner to PBMs, which results in access to the most data points, thereby increasing the likelihood that they will be able to find lower prices than competitors and driving further user growth.

The same dynamic occurs with telehealth where telemedicine providers partner with GoodRx and increasingly compete against each other by offering discounts to GoodRx users with the goal of making it up with increased volume.

Branding

GoodRx is the leading prescription pricing tool in the US, and spent $177 million in marketing last year, approximately 45.6% of total revenue. With an NPS of +90 among patients and +86 among providers, as well as a 4.8/5.0 rating on the App Store and Play Store over 743,000 reviews and being the second most popular medical app, it’s clear that GoodRx has established significant mindshare.

Scale Economies

Providers actively champion GoodRx with over 68% having recommended GoodRx before. Combined with GoodRx’s brand and lower prices and they are able to acquire users at a fraction of the cost as competitors with an under 8-month payback period. Besides SingleCare and RxSaver, other programs have struggled to get the same traction and new upstarts would have to spend significantly on user acquisition and subsidizing drug costs in order to match GoodRx’s value proposition.

Counter-Positioning

Pharmacies cannot lower cash prices significantly without damaging their core business, placing GoodRx in a unique position to serve an increasing number of cash-pay patients.

Financials

GoodRx has grown revenues at a steady 57% CAGR between 2016 and 2019, driven by monthly active consumers (MAC) and gross merchandise value (GMV) which grew at a 59% and 52% CAGR respectively. It has unheard of 95% gross margins and is already quite profitable with adjusted EBITDA growing at a 75% CAGR from 2016 to 2019.

GoodRx recently reported strong Q3’20 results. They achieved $140.5 million in revenue (+38% YoY), maintained extraordinary 94.6% gross margins, achieved a 37.8% adjusted EBITDA margin and grew net income by 53% YoY. Spending on sales and marketing remained consistent at 43.3% of revenue but an increase in R&D and G&A (mostly due to IPO) spending led to a 460 basis point decrease in adjusted EBITDA margin YoY. They logged a record 4.9 million monthly active consumers, up 29% YoY (MAC only includes prescription customers).

Prescription transaction revenue grew 30% YoY to $124.4 million and other revenue, including their subscription, pharmaceutical manufacturer, and telehealth business lines, grew 170% YoY to $16.1 million. They also launched over 30 new manufacturer partnerships as they continue to expand into brand medications and signed a multi-year extension of their Kroger Rx Savings Club partnership. They issued Q4’20 guidance of 31% YoY revenue growth, adjusted EBITDA margin of 30-31%, and MAC growth of 4-5% sequentially. They attribute the deceleration in revenue and MAC growth to COVID-19 having a negative impact on the provider visit volume and hence the number of prescriptions being issued, although the 80%+ repeat activity rate should preclude them from significant volatility. Moreover, subscription customers are not included in the MAC count which is increasingly significant as the number of subscribers increased 15x from December 2018 to June 2020. The decline in Q4 adjusted EBITDA margins is due to increased investment in S&M with a shift of spend from the third quarter. Long-term EBITDA margins targets are ~40%.

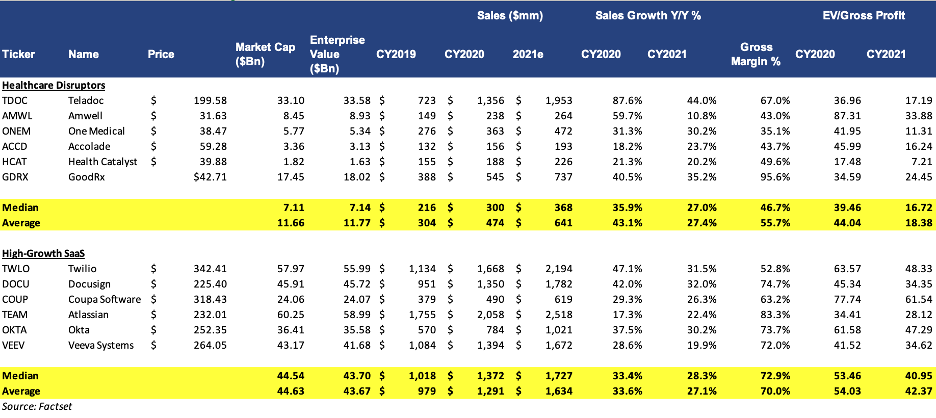

Source: Q3’20 Shareholder Letter

GoodRx seems relatively undervalued trading at 25.5x 2021 gross profit estimates, if it trades in line with health tech peers it would lead to a price target of $60.20 per share, ~41.1% upside from current levels. I believe it deserves a premium for its rare blend of profitability and strong revenue growth. Although GoodRx isn’t SaaS, its prescription offering is highly predictable with 80% of transactions coming from repeat activity as mentioned previously. In addition, PBMs are required to continue paying GoodRx for transactions it generates even after contract termination, as long as the pricing for the drug remains the same. It is the clear leader in its core prescription business with a massive TAM and has significant optionality as other revenues should increasingly drive top-line growth.

Risks

GoodRx faces three primary risks: PBM concentration, margin contraction from an increasing mix shift towards their lower margin telehealth offering, and healthcare reform.

GoodRx’s top three PBM partners accounted for 48% of revenue in H1’20, down from 55% in 2019 and they now work with over a dozen PBMs in total. However, GoodRx is a value-add for these PBMs because they can leverage the cash-network rates they negotiate with their pharmacy networks to access GoodRx’s userbase. Thus, there is not much rationale not to work with GoodRx and as such, they have never lost a PBM partner. If the industries that GoodRx competes in see increasing consolidation, it would be a threat to GoodRx’s take rates however as suppliers gain bargaining power.

GoodRx’s telehealth services also operate at significantly lower contribution margins than their prescription business (HeyDoctor at breakeven) which will pressure their margins as it is growing significantly faster. I believe that the investment is worth it though, as it will allow GoodRx to further monetize their customer base and make the platform stickier for both patients and physicians. In addition, the core prescription business works against itself longer term, because as prices start to come down across the board, then the need for a GoodRx will start to diminish. The telehealth market is developing fast and very much still in land-grab mode, so although this will continue to be a drag on margins for GoodRx right now, it will lead to stronger revenue growth over the longer term. It should also be noted that telehealth only formed ~17% of other revenues and 2% of total revenues in H1’20 so it is very early. Contribution margins with manufacturer solutions are also significantly higher at ~80%, and comparable to their prescription business so how fast that grows relative to telehealth will be important to consider.

Lastly, reform on prescription drug pricing is been a frequent issue every election but no substantial change has been achieved. Doug even said that he wants the government to solve this and that GoodRx shouldn’t have to exist. Medicare Part D, which covers prescription drug costs, was enacted by George W. Bush in 2006 and has met opposition ever since because the government can’t negotiate prices with drug manufacturers but efforts to repeal this have fallen flat. Besides that, Trump recently signed four executive orders aimed at lowering drug prices:

Set Medicare reimbursement levels for certain drugs based on the rates that other developed countries pay, a “most-favoured-nation-price”

Allowing pharmacies and drug wholesalers to import drugs from Canada where prices are lower

Directing Federally Qualified Health Centers to pass along discounts on insulin and EpiPens to their patients

Banning drug manufacturers from providing rebates to PBMs and insurers for people who have prescription drug coverage under Medicare Part D and passing those discounts to consumers directly

However, signing these orders is just the first step in making these changes into reality, which would face intense opposition in the courts, and even if implemented, would not make a substantial difference in drug prices. For example, drug manufacturers negotiate rebates with PBMs for better coverage, with the goal of encouraging patients to choose their brand name drugs. If the patient buys that drug, PBMs receive a rebate which they share with insurance companies. The proposal to ban rebates was originally dismissed because it would lead to higher costs for insurance companies, higher premiums for patients, and higher Medicare spending by the government. Furthermore, as I mentioned, branded medications have historically only formed 5% of GoodRx’s revenue base. Overall, significant disruption to GoodRx’s business model is unlikely to happen in the near-term.

Conclusion

Doug and Trevor are on a mission to build the leading consumer-focused digital health platform in the US. By helping users filter PBM’s negotiated rates and telemedicine offerings, they are putting the power back in the consumer’s hands just like it is in every other industry and becoming the first stop on any health journey.

American healthcare has never been more unaffordable and COVID-19 exacerbated the issue by leaving millions more without coverage. When the government’s hands continue to be tied as a result of political gridlock and intense lobbying by powerful industry stakeholders against any significant change, GoodRx has never been more important. Its business model is a win-win-win for PBMs/insurers, healthcare consumers, and providers and quite literally saves lives. It’s clear the importance of this mission reverberates through the company as well with a 4.6/5.0 Glassdoor rating and 98% approval of the co-CEOs.

The combination of wide moats, a huge TAM, and visionary management is hard to find, and strong revenue growth coupled with high profitability proves that they know how to execute. I believe that healthcare will be one of the most exciting industries to be in this decade as a new generation of patients, spurred by unbearable costs and a renewed focus on wellness and empowered by technology platforms like GoodRx, shape a consumer-focused future.

Subscribe to my newsletter to get updates on new articles right in your inbox.

Disclosure: Richard Chu owns shares of GDRX and TDOC. Luca Capital owns shares of GDRX and TDOC. Saga Partners owns shares of TDOC. Saga Partners does not have a position in GDRX at the time of writing.

You didn't mention the part where GoodRx has been and continues to sell patients' private health information, as discovered by Consumer Reports earlier this year.