GoodRx: Groupon or Google?

Can GoodRx build a sustainable business on top of drug discounts?

For a detailed explanation of what GoodRx does, I encourage you to read my November 2020 article or Saga Partners’ H1’21 Investor Letter. The focus of this piece is to better explain why I believe GoodRx has a more defensible business model than the market thinks and has a business model more similar to a Level 3 Aggregator like Google than a Groupon.

An Overview of GoodRx

GoodRx at a high level is a prescription savings marketplace that aggregates coupons provided by PBMs and shows patients the lowest available price for any given drug across almost all pharmacies in the US. GoodRx boasts average discounts of 79% and has 7.5 million monthly users with dominant mindshare among consumers and physicians (+90 NPS and +86 NPS respectively). It earns revenue from a 15% take rate of each transaction that is paid by the pharmacy to the PBM which is then passed on to GoodRx. Our understanding is that the admin fees that PBMs charge pharmacies are the same across the board. In 2020, GoodRx collected almost $500 million in fees from PBMs at a 95% gross margin. To date, GoodRx has saved consumers over $30 billion.

Unlike Groupon, GoodRx has zero supply costs as each PBM can fulfill as many claims as GoodRx sends them, therefore it is limited only by the demand it can generate. Once onboarded, GoodRx is automatically accepted at every pharmacy within the PBM’s network, reducing the effort required to just signing up a few PBMs rather than tens of thousands of pharmacies. Pharmacies also cannot offer GoodRx’s prices directly due to their PBM contracts and PBM’s cash prices may vary significantly for the same drugs. Thus, patients will always need to go through GoodRx for every transaction to ensure that they are getting the best price for any given drug. Better prices lead to more consumers which leads to more PBMs and even better prices. Finally, GoodRx is increasingly monetizing their high user engagement by selling ads to pharma and health tech companies looking to reach healthcare consumers.

Source: GoodRx Shareholder Letter

GoodRx has an incredible track record of growth and profitability, with 56-59% revenue growth from 2016 to 2019 and growing 42% during COVID when provider visits and hence new prescriptions declined up to 60% YoY. Because GoodRx is an asset-light marketplace, it has taken an incredibly low amount of capital to scale. Until a 2015 investment from PE firm Francisco Partners, they had only raised one $1.5M seed round from angel investors and were already profitable by 2013, just two years after they were founded.

GoodRx’s prescription business is highly predictable as 80% of transactions are repeat. Although GoodRx defines this as using it just twice within a 3-year span, expert calls indicate that churn is very low as these core users are on maintenance drugs and thus have their GoodRx code saved at their favourite pharmacy which they use every time they need a refill.

Source: Tegus

The fact that GoodRx is the only marketplace is a main contributor to its success. The other discount cards adopt different models, such as partnering with pharmacies directly like Blink Health or leveraging just a single PBM like SingleCare, Amazon Prime Rx, or Walmart+ Rx for Less. GoodRx also has a patent that protects its marketplace model. Thus, it is the only platform where PBMs are forced to compete against one another for access to its volume. Since PBMs can vary pricing, they are thus incentivized to give GoodRx their best rates because it is the largest prescription savings platform by far. Even if we assume that the patent does not hold and competitors can also eventually form relationships with multiple PBMs, GoodRx still should maintain the best pricing because it has such a large lead in market share versus the other independent discount cards and can thus drive the most volume for PBMs. Expert calls indicate a very strong correlation between conversion and price.

Source: SensorTower, Saga Partners

Source: Silver Mount Capital, follow Silver Mount on Twitter

PBM and pharmacy-owned prescription savings programs are also competitors with Optum Perks making a particularly aggressive push recently. However, the issue with PBM-programs is that they are limited to their own networks instead of sourcing the lowest price of all PBMs. This results in worse prices and fewer accepted pharmacies, Optum is only at 64,000 for example compared to GoodRx’s over 70,000. PBMs also have had a hard time matching GoodRx’s brand awareness despite significant investment.

With pharmacy-owned programs such as ones by Costco and Walmart, they still need to partner with a PBM to adjudicate those claims. Costco partners with Navitus and Walmart with MedImpact, making them dependent on the rates of that PBM and naturally limited to their own pharmacies. Pharmacies primarily see discount cards as a way to drive increased foot traffic and improve customer loyalty but face some conflict of interest as it would further cannibalize their margins.

Another source of GoodRx’s success has been the incredible job they’ve done in driving top-of-funnel awareness. GoodRx has integrated its pricing information into leading EHRs and more recently formed a partnership with Surescripts which has a network that reaches almost all EHRs in the US. GoodRx also distributes cards to doctor’s offices and has a GoodRx Pro app for providers. This has helped unaided brand awareness become a major driver of their business with 68% of providers having recommended GoodRx to their patients as the 20% to 30% of prescriptions that are left unfilled benefit no one. Doctors and pharmacists have also integrated GoodRx into their workflows, something that cannot be said for its competition.

Source: Tegus

However, despite GoodRx’s outstanding numbers, it remains one of the most highly shorted stocks on the market with almost 28% of the float short as of the time of writing. Since coming public, GoodRx has faced a very tough newsflow, from Amazon announcing it would release a competing discount card in the form of Amazon Prime Rx last November to Walmart following up with its own prescription savings benefit Walmart+ Rx for Less this past June. I still don’t view Amazon Prime Rx as a significant threat because they are not able to compete with GoodRx on price nor brand awareness and in their recent earnings call, GoodRx mentioned that Amazon’s discount card had seen almost no retail traction so far according to third-party surveys. The cash card industry also has yet to fully recover from the pandemic, impacting GoodRx’s ability to deliver substantial beat and raises. Nevertheless, GoodRx has showed some promising signs of recovery as prescription revenue growth reaccelerated this past quarter to 8% sequentially, from just 2% in Q1 due to COVID, bad weather, and a weak flu season. GoodRx also guided for continued sequential acceleration going into Q3.

Why GoodRx’s Business Model is Defensible

I’ve heard many dismiss GoodRx as just lead-gen for PBMs, Groupon for drugs, or another unnecessary middle-man. These theories all underlie the consensus belief that GoodRx is subject to the whims of PBMs and has a fragile business model that takes advantage of discrepancies between PBMs’ drug prices. However, I believe that GoodRx is actually better positioned than PBMs owing to its unique marketplace flywheel and brand awareness. This not only guarantees GoodRx will continue to maintain its pricing advantage over competitors, but it also expands its market beyond the uninsured and those on high-deductible plans to those who are fully insured.

I’ve talked about why payers and PBMs have made healthcare so difficult to disrupt. They control the entire value chain as they own demand. You could come out with a product that radically improves the patient experience but if you can’t demonstrate ROI to payers then you won’t get reimbursed. Similarly, PBMs negotiate reimbursement rates with pharmacies but have no incentive to share these publicly because they can charge a higher set of prices to payor clients, pocketing the spread. Because there’s no transparency, prices can vary a lot and ultimately get passed down to the patient. Digital health leaders Teladoc and GoodRx have only grown to their current scale because the payers and PBMs have allowed it.

This is why I find the argument that GoodRx is “just another middleman” to be frivolous. If GoodRx were to come in and announce that they were going to disrupt healthcare and adopt this radically different model then they would have gotten nipped in the bud. They need scale and the only way they can achieve it is by partnering with incumbents.

“In fact, incumbents nearly universally benefit from the presence of aggregators, at least at first (publishers benefited from Facebook, merchants from Amazon, content makers from Netflix, web businesses of all types from Google). It is only when the aggregators’ consumer base becomes dominant that the inevitable squeeze on incumbents — specifically, on their profit margins — begins, and it is in the long-run irreversible.” - Ben Thompson, Stratechery

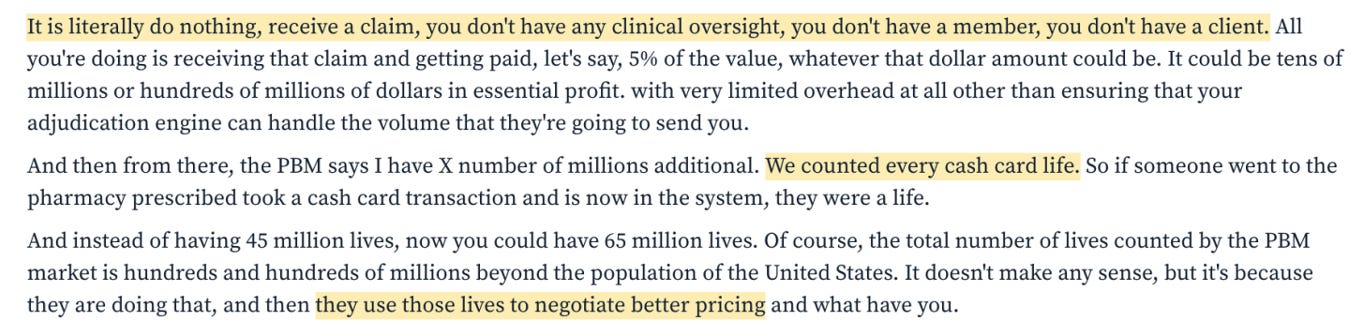

GoodRx offered a value proposition that no rational executive of a large, publicly traded company could turn down: free money. All PBMs had to do was adjudicate these claims that GoodRx was passing along, and they could even count those cash card lives as their own when it came to negotiating rebates or drug pricing.

Source: Tegus

However, when GoodRx is used for insured consumers, PBMs no longer receive a rebate which are partial refunds that pharma manufacturers provide to incentivize PBMs for better coverage, with the goal of influencing patients to choose their brand name drugs. If the patient buys that drug, PBMs share their rebates with payers. PBMs initially benefitted from GoodRx because they could access uninsured patients and reduce the 20-30% of scripts that get left on the counter, but as more insured consumers use it, GoodRx is increasingly becoming a net-negative. This is why I believe Navitus and MedImpact have consistently accounted for more than 10% of GoodRx’s revenue since 2018 despite not controlling near the number of lives as the larger PBMs (thanks to the10thman for pointing this out). The only explanation is that the larger PBMs are afraid of channel conflict by losing rebates and are thus not giving their best prices to GoodRx. I also believe this is why Caremark does not appear to be a partner, as they have the most to lose given they are the largest PBM. But for smaller PBMs, it seems this is absolutely worth it because the potential volume they can capture on GoodRx more than makes up for their relatively low number of covered lives.

Source: Tegus

Now, an interesting dynamic has recently been playing out as expert calls have indicated that Optum and Express Scripts currently are driving the most volume for GoodRx. As a quarter of the admin fees are usually retained by the PBM, the top PBMs on GoodRx are potentially able to capture tens of millions of dollars in fees. Given OptumRx did $87.5 billion in revenue in 2020 this may seem like a miniscule amount but remember it comes at essentially no additional cost. OptumRx had $3.9 billion in operating income which was unchanged from 2019 so the prospect of capturing tens of millions or even eventually hundreds of millions in incremental EBIT can definitely be attractive. Optum and Express Scripts combined accounted for 45% of the PBM market by claims managed.

This competition has been gradually improving the average prices that GoodRx can offer on its platform, from an average discount of 58% in 2016 to 79% in 2020. This has gotten to the point where GoodRx is becoming even cheaper than insurance co-pays in some cases. Compare these two statistics, both from a GoodRx blog one year apart:

“For the 100 most prescribed drugs, GoodRx users paid less than the average insurance copay 37% of the time, with savings up to 54%.” - March 2020

“For the 100 most prescribed drugs, GoodRx users paid less than the average insurance copay 55% of the time, and users who paid less than the average commercial insurance copay saved an average of 52%” - June 2021

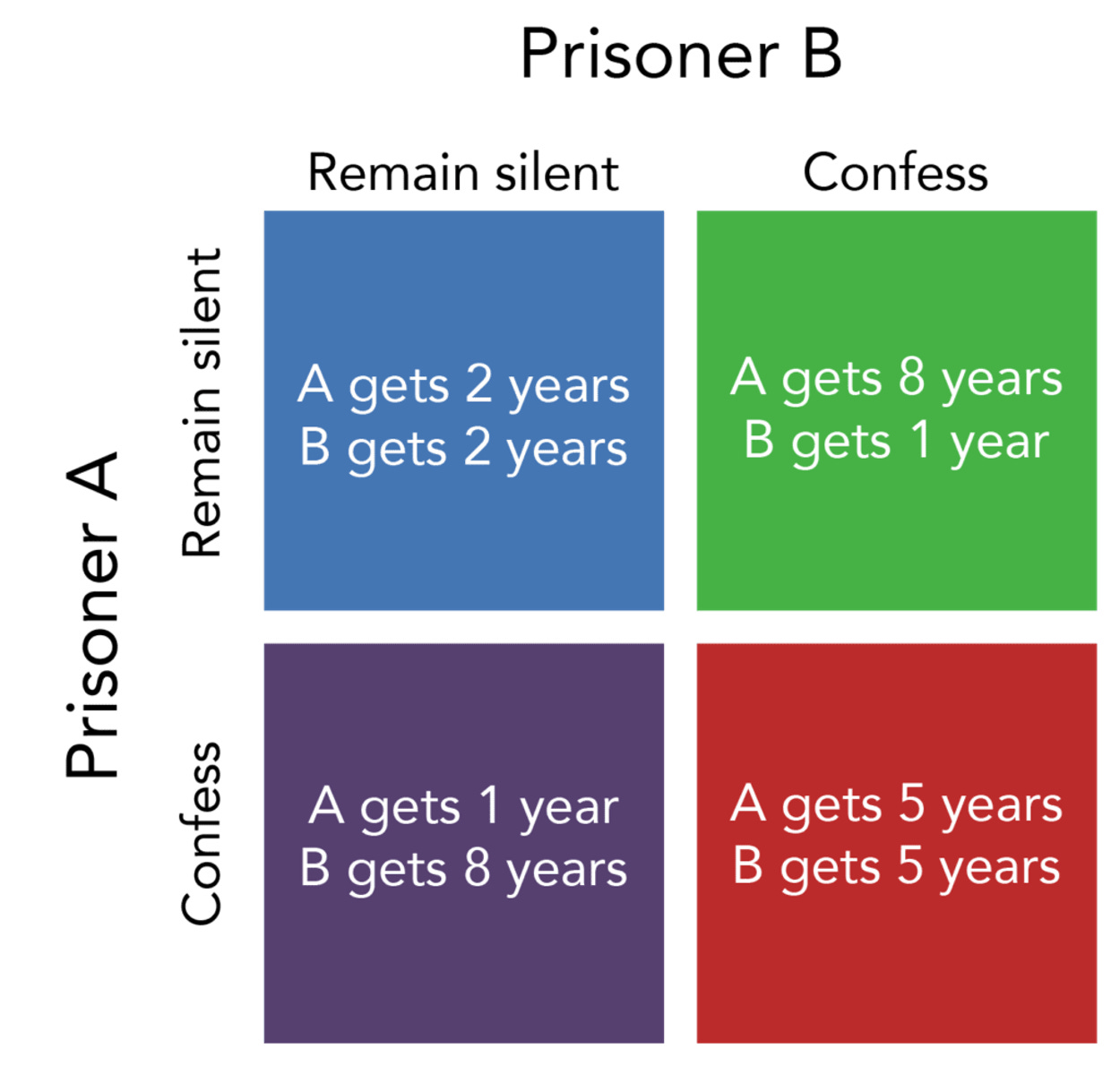

So why are these large PBMs embracing GoodRx by offering increasingly aggressive rates? Are they not aware that they are, in fact, helping GoodRx cross lines that they would prefer it never cross? I believe they are much smarter than that and are fully cognizant of that fact, but game theory helps explain why the unique marketplace dynamics that GoodRx possesses force the PBMs to stay on the platform and not collude.

Source: Lumen

Prisoner’s dilemma explains why two rational individuals might not cooperate, even if it is in their best interests to do so. Two prisoners are interrogated separately. If they both remain silent, then they both get two years of jail time, which is the best overall outcome. However, if one of them confesses and the other doesn’t, then the one who confesses only gets one year while the other gets eight years. And if they both confess then they both end up with five years. Because each prisoner cannot trust the other, they both choose to protect themselves at the expense of the other. For a real-world example, this concept is also demonstrated in the British TV show “Golden Balls”.

Now, why is this relevant to GoodRx? Well, PBMs all offer the same service to GoodRx, which is why I am not concerned about concentration risk as much. If one PBM decides to leave the platform, then another PBM can easily take its place with minimal impact on the marketplace’s overall pricing. In fact, GoodRx frequently mix shifts depending on which PBM offers it the best margin and price. So, if Optum realizes that GoodRx is taking its insured volumes and decides to stop processing claims from GoodRx, then it will be effectively giving that volume to a competitor. Also, they’re not just cannibalizing their own insured patient base, but potentially stealing those who were previously locked under another PBM’s base too. The marketplace will always be more powerful than any one player because of the aggregated lives it controls.

Thus, there is very little incentive for PBMs to collude. Just one PBM could stay and win the most volume, so the NPV to make all PBMs agree to collude would have to be higher than what each PBM could individually hope to earn on GoodRx, which can eventually scale into the hundreds of millions. This is kind of similar to Roku’s relationship with content providers. Netflix needs to be on Roku, or risk losing share to other content providers, and them leaving Roku would accomplish nothing except give more share to the next aggregator and restart the problem.

In one expert call, it was noted that GoodRx has already become large enough that PBMs have to work with them and that PBMs are struggling to prove their value beyond the discount card as consumers take more of the cost burden with high-deductible plans.

PBMs may even want to give better rates to GoodRx than their own health plan clients or discount cards. One may think this will cause problems with payers but since PBMs all offer the same service to GoodRx, they are anonymized and thus don’t need to worry about conflict with payers (thanks to Drug Channels for pointing this out). This dynamic should not only continue to ensure that GoodRx’s prices are better than the competition but make it increasingly relevant to the commercially insured and thus open up the TAM significantly. I believe that Caremark, the largest PBM with 32% market share, will eventually need to partner with GoodRx because the opportunity cost of not participating and capturing those volumes will be too great; this should unlock even better prices.

In another expert call which I’ve shown an excerpt from below, there was some stipulation that PBMs must conform to average discounts as negotiated with pharmacies. If this dynamic is true, then that means that by giving GoodRx better prices, PBMs must be offering another discount card or even their own health plan clients worse prices. Given GoodRx has the largest insured userbase, over time, I believe the discrepancy between GoodRx’s prices and competition should only grow. However, I have yet to find a definitive answer regarding this.

Source: Tegus

To summarize, GoodRx, by being the largest and only prescription savings marketplace forces its PBM partners to compete for its volume, ultimately passing increasingly better savings back to consumers.

Where Does This Fall Apart?

A significant risk is the online-offline handoff because pharmacies have an opportunity to disintermediate GoodRx at the point of sale by pushing their own programs. They still get the foot traffic from GoodRx but would undercut them on price and avoid paying them their fee while retaining the customer. Blink Health attempted to circumvent this by having consumers pay within the app but by favouring certain pharmacies over others, they antagonized their pharmacy partners who ended up not accepting them. GoodRx is focused on maintaining good relationships with pharmacies so they likely wouldn’t do that. Instead, the counter-argument would be that the admin fees that pharmacies pay PBMs are the the same across the board, so they have no incentive to prefer one discount card over another. Furthermore, most chain pharmacists don't have time or the energy to do this because they have to price compare what it would be versus GoodRx and that they won't be able to beat GoodRx prices most of the time. Pharmacies also may not incentivized to promote their own discount programs because they make a lot of profit when they charge uninsured patients their U&C (cash) pricing. Finally, GoodRx Gold mitigates that risk by removing the incentive for pharmacies to redirect as they do not have to pay an additional fill fee to GoodRx.

Another risk is pushback from pharmacies. Given PBMs’ MAC lists (reimbursement) change all the time at their discretion, pharmacies often end up taking a loss on some drugs. MAC lists were originally intended to control drug prices by forcing pharmacies to acquire them at reasonable prices using the negotiating leverage that PBMs’ control from their covered lives. However, the complete lack of transparency results in PBMs taking much of that profit for themselves instead of passing it back to consumers. Owner-operated independent pharmacies that account for 37% of US pharmacies (up from 34% in 2010) and rely on prescription revenue have often openly expressed their dislike of GoodRx, sometimes going so far as to offer to match GoodRx’s prices. However, in doing so, they would be illegally breaking their PBM contracts as they are manipulating their U&C (cash) prices. Although this has been hard to control, I believe that as GoodRx continues to scale, PBMs will increasingly take a harder line against these pharmacies as they will be losing a significant amount of revenue.

Independent pharmacies’ weak competitive position relative to PBMs and GoodRx is evident in their response to the Surescript partnership in which they claimed “GoodRx only displays prices for their pharmacy partners, which would leave out independent pharmacies”. They posit that “In a coupon-free world, market forces would drive the pharmacy charging $268 for rosuvastatin (which costs $0.03/pill) down to a reasonable amount or suffer extinction.” If this were the case then uninsured patients wouldn’t be paying insane mark-ups that enable discount cards to claim average discounts of 79%. The reason being that the cash pay prices that pharmacies set are guided by PBMs so, in order to protect their reimbursement rates and thus the majority of their revenues, pharmacies have artificially set prices much higher than they should be. I explain this dynamic in more depth in my November article. But the overall take-away is the same: by enabling transparency into PBM MAC lists, GoodRx is empowering the healthcare consumer and thereby restoring free-market economics to this industry.

Chain pharmacies, meanwhile, are increasingly viewing prescriptions as a loss leader in order to drive foot traffic and cross-sell other higher margin products. A recent GoodRx survey revealed that 75% of consumers purchased non-prescription items when picking up a prescription and about half of those people also spent more than $40 on non-prescription items. Furthermore, the fact that Rite Aid, Kroger, and other pharmacies voluntarily partnered with GoodRx for Gold means that they must be seeing a material increase in foot traffic. Additionally, the fact that they are offering their own discount cards also indicates that they must believe the benefit of the additional foot traffic they'll get from being competitive on cash-pay prices is greater than the margin they'll lose.

Medicare for All and widespread cost-plus pricing are the big existential risks, but the former will be incredibly difficult to pass and the latter will be very difficult to scale. Regulation on drug pricing will always be a hotly debated topic but I don’t see any material change anytime soon, after all, what hurts GoodRx will also hurt the PBMs and they will do whatever is necessary to prevent that from happening.

Another commonly cited risk is that the discount card market simply isn’t big enough. For GoodRx to achieve a 15% IRR from here assuming 3.5% dilution, they need to reach a ~$39 billion EV by 2026. Let's assume they get 40% FCF margins and trade at 35x EV/FCF, so they need to generate $1.11 billion of FCF and $2.78 billion in sales which represents a 30% 5-year CAGR. Consensus currently has them at $2.6 billion in sales by 2025. The average cost per script is $30 times a 15% take rate = $4.50 per script. $2.78 billion / $4.50 per script = ~620 million scripts or ~11% of the total 5.4 billion US market for scripts.

If we assume cash cards can address 90% of the uninsured population, 70% of the high deductible plans, 40% of HMO/PPO plans, and 40% of the Medicare/Medicaid market, that's ~2.7 billion scripts at least. So, 620 million scripts is 23% market share and very achievable in my opinion. I think GoodRx currently has at least 40% market share and they are continuing to capture share. I also believe my estimate of their penetration into the commercially insured population is highly conservative given the thesis I’ve outlined above. This also not taking into account their other revenues which was 18% of their total revenues last quarter and 11.3% of FY'20 revenues, up from 6% in 2019 and 2.6% in 2018.

Regarding this segment, I am especially excited about the potential of manufacturers’ solutions. Management provided significantly more transparency last quarter by revealing that they are only penetrated in 10% of 550 pharma manufacturers but 19 of top 20 (though only have 4% of their over 1000 brands today). Pharma can advertise to GoodRx’s 20 million monthly visitors (10x more traffic than pharma's own sites). It's growing revenues 3x YoY, 85% of which is flat fee, with a NRR of 150%+. Pharma digital ad spend grew 43% in 2020 and other players such as Doximity and OptimizeRx have done incredibly well. I believe GoodRx is uniquely positioned to reach consumers at the bottom of the funnel and further monetize their large userbase with minimal incremental marketing.

GoodRx is also increasingly investing to become the leading source of prescription information with their partnership with Surescripts and new focus on brand marketing and editiorial content. This not only will reduce CAC over the long-term by turning them into a household name but turn GoodRx into an increasingly attractive advertising channel for other health tech companies such as GoHealth and Hims.

In the near term, GoodRx, along with the rest of the cash card industry, continues to be highly handicapped by a tough environment with expert calls suggesting that new prescription volumes are still down high single-digits from baseline. With cases flaring up again due to the Delta variant, it might take longer than expected for volumes to recover to pre-COVID levels but everything I’ve read suggests that GoodRx continues to gain market share and is not being affected by all the competitive headlines. I still believe that it has the best risk/reward of all my positions, and it remains my largest holding.

Subscribe to my newsletter to get updates on new articles right in your inbox.

Disclosure: Richard Chu has a position in GDRX, OPRX, and ROKU. Luca Capital and Saga Partners own shares of GDRX, ROKU, and AMZN.

Hi Richard - Thank you for another nice analysis! I wonder what is your take on the growth of GDRX's MAU, which is currently at 6 million and growing at 20~30% YoY for past quarters. Please correct me if I am wrong but this appears rather slow given the low penetration rate of a purported large TAM (~5%, with 30 million uninsured and 100 million on HDHP) and some heavy spendings on S&M (consistently ~50% of revenue). Many thanks in advance!

Hey man! Enjoyed the latest on $GDRX. I just finished listening to the last Q call. Certainly feels like mgmt doesn't wanna talk much about their tele health service. I keep seeing ZocDoc ads running on repeat on TV when I'm at the gym. Can't understand why GDRX is not running these... linear TV viewers are surely their target demo. Are they hesitant to dive in here? Or is it concerns about diversifying into a much lower margin biz and bringing their overall margins down?